Warren Buffett rejected the suggestion the U.S. stock market is "too frothy" right now as the major indexes re-approach their all-time highs.

"I think we're in a range, and it's a big zone always, of reasonableness. But stocks ought to be higher every 10 years.There's a plow back of earnings that goes back year after year. Stocks will become worth more decade after decade, not in any precise manner, not in an even manner or anything of the sort. But 10 years, 20 years, 30 years, stocks will be worth more than they are today."

Asked if he agreed with investor David Einhorn's warning that "we are witnessing our second tech bubble in 15 years," Buffett said he doesn't always understand tech valuations, but it's not like the period before 2001 when "you could almost sell anything and capitalize eyeballs and all of that. I don't think it's reached that point and certainly I don't think the general market level is going to bubble up."

Buffett also said Coca-Cola's controversial equity compensation plan was "excessive," but Berkshire Hathaway abstained in the shareholder vote.

Read MoreComplete transcript of the Buffett interview

Buffett said he and partner Charlie Munger didn't want to vote against the plan because he didn't want to show any disapproval of management, and he has enormous respect for CEO Muhtar Kent. "I love Coke, I love the management, I love the directors, so I didn't want to vote no. Kind of un-American to vote no at a Coke meeting."

He added, "I respect the Coke organization. I just don't like the plan."

Buffett said he generally doesn't like to vote against compensation plans and, in his role as a board member on various companies, has sometimes voted for plans he didn't really like. Objecting to a decision of a compensation committee "is a little bit like belching at the dinner table. You can't do it too often. If you do, you find you're eating in the kitchen pretty soon."

Read MoreBuffett: I've voted for bad pay plans

Earlier Wednesday, the company said 83 percent of shareholders approved the plan. Critics, most notably the activist investor David Winters, said it would dilute the holdings of current shareholders too much.

Winters had publicly called on Buffett to take a stand against the plan. Before Buffett spoke, WInters said he was surprised the billionaire had not "seized the opportunity" to oppose it before the vote.

Buffett responded that he "didn't want to be in the position of campaigning for either side."

In a statement, Coca-Cola said it "respects Mr. Buffett's philosophical stance on equity-based compensation." Calling him a "wonderful counselor through the years," Coke said it looks forward to continuing its "productive relationship" with Buffett for "many years to come."

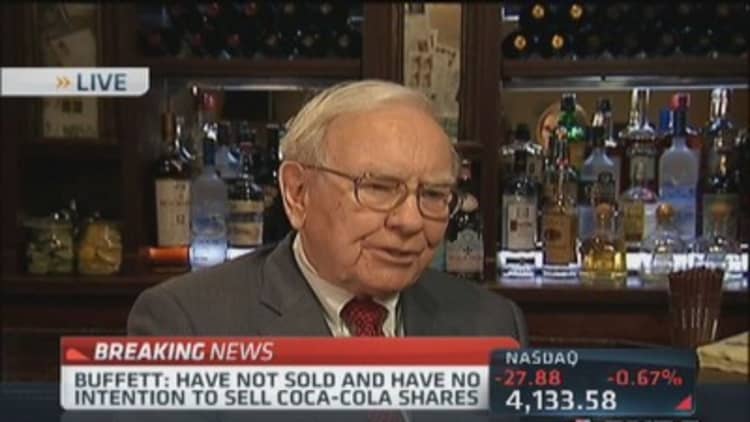

As of December 31, Berkshire owned 400 million shares of the company, just over 9 percent of the shares outstanding. Buffett said he has no plans to sell any of them. The stake is currently worth about $16.3 billion.

Buffett acknowledged that activist investors are getting stronger and "CEOs are terrified" of them.

Buffett denied he had "soured" on his enormous investment in IBM, and said Berkshire bought some more shares this year, although the purchases didn't come after the company's most recent earnings report. He said he wouldn't "rule out" future IBM stock buys.

Buffett spoke in a live interview with Becky Quick on CNBC's "Closing Bell." It followed his meal in New York with the anonymous bidder who paid $1,000,100 to win last year's "Power Lunch" auction benefiting San Francisco's Glide Foundation.

—By CNBC's Alex Crippen. Follow him on Twitter: @alexcrippen