Former Pimco CEO Mohamed El-Erian told CNBC on Monday that the bond market has figured out what stocks haven't yet: The Federal Reserve, while remaining committed to supporting asset prices, is "targeting different things."

"We are in a transition [at the Fed] from a regime that was tool-based to a regime that is objective-based," he said. "We were told exactly what they were going to do. Now what we're going to do … is conditional on outcomes. That increases uncertainty."

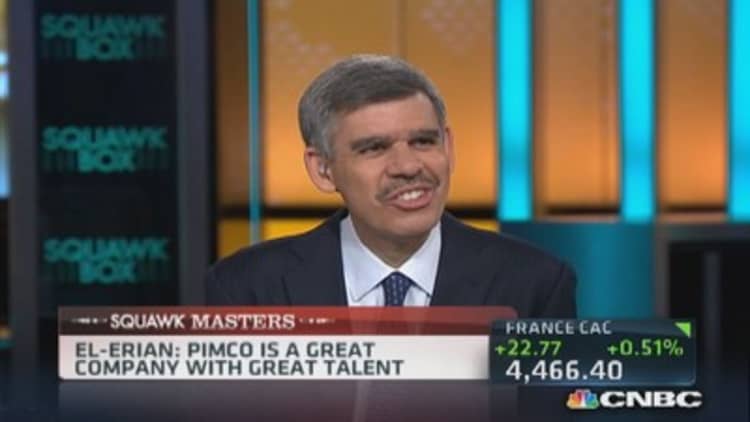

Appearing on "Squawk Box," El-Erian also addressed why he decided to earlier this year leave Pimco, where he had been considered the heir apparent to founder Bill Gross. He said it was time for him to do something different and that it was a "difficult personal decision."

As for the central bank, which meets later this week, policymakers will likely reduce their quantitative easing in a fourth round of tapering of $10 billion to a pace of buying $45 billion worth of bonds and mortgage-backed securities each month, he said.

"They are going to be exiting QE by the end of the year," he continued. "They are going to keep interest rates at zero and they are going to strengthen forward policy guidance."

The stock market is in a tug-of-war between the changing Fed and geopolitical uncertainty on one side and renewed merger activity and earnings momentum on the other, El-Erian said.

"All the corporate actions, for me if you put them all together, they fundamentally speak to companies increasing comfortable going from defense to offense. That's good."

Read MoreChurning market means gut-check

But he stressed that Ukraine is serious. "If sanctions go from targeting individuals to targeting sectors you can tip Europe into recession, and the stock market is not going to like that."

Barring a worsening situation in Ukraine, El-Erian expects Europe to grow about 1 percent to 1.5 percent this year. He puts U.S. growth at about 3 percent.

El-Erian's Pimco departure

While refusing to comment directly on his reportedly rocky relationship with Gross that was said to be at the heart of his resignation from Pimco, El-Erian said he has nothing but admiration for his former partner.

Earlier this year, El-Erian abruptly left the investment giant in the wake of differences with Gross, who publicly let his displeasure with the resignation be known.

Read MoreDamage control at Pimco after Gross, El-Erian clash

Saying he also wanted more family time, El-Erian has stayed on with Pimco's parent company, German insurer Allianz, as chief economic adviser, and he attends meetings of the international executive committee. He's working on a book as well.

On CNBC Monday, he praised Gross as one of the best investors in the world, despite Pimco's lackluster performance recently. "Do you know any long-term investor who hasn't had a rough time?"

Over the past year, Gross has been dealing with weak performance and massive outflows in several marquee funds at Pimco, which has $2 trillion in assets under management.

The flagship $232 billion Total Return bond fund, managed by Gross, has seen $51.62 billion of net outflows in the 12 months ending March 31, or 18 percent of beginning period assets under management.

—By CNBC's Matthew J. Belvedere. Reuters contributed to this report.