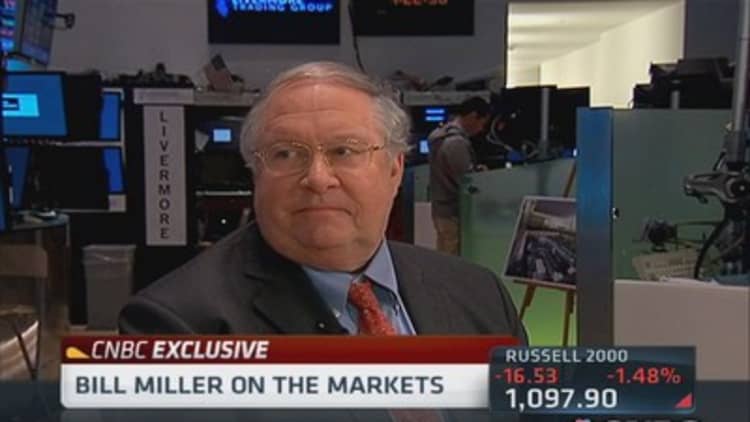

Apple's run isn't over, according to legendary stock picker Bill Miller.

The tech giant has seen its stock continue to climb, breaking $600 a share earlier this month for the first time since October 2012, and Miller thinks it will still go higher.

"It's not as attractive as it once was, but I still think it's worth $700, $750," he told CNBC's "Closing Bell" Tuesday.

Apple closed slightly higher on a down day for the markets. The Dow, and Nasdaq all posted losses after several retailers announced disappointing quarterly results and Philadelphia Federal Reserve President Charles Plosser said rate hikes might happen sooner than expected.

Read MoreStocks decline for first day in three as retailers disappoint

Miller, the former chairman of asset managing firm Legg Mason Capital and current chairman and CIO of LLM, said he's still bullish on the market and stands by his statement last month that "after this correction you can throw a dart at the market and about anything you hit is gonna go up the next six months."

"The bears hate the market because it won't go down and the bulls hate it because it won't go up. But it's a great market, I think, for people who actually want to invest who have a time horizon longer than the next 30 minutes to 3 weeks," he said Tuesday.

Read MoreHow to make money in a changing market: Bill Miller

Miller sees opportunity almost everywhere. In addition to Apple, he also likes Amazon, which he called buyable for the first time in a number of years.

"If it takes Amazon two years to get back to where it was a few months ago that should beat the market," he noted.

While guidance spooked investors, he said the Internet retailer's gross profit dollar growth outpaced the growth of sales, which historically is a very bullish sign for Amazon.

Read MoreUh oh! Fed exit may cause 20% stock drop: Analyst

He also is bullish on home builders, and said the fundamentals for the sector are improving.

"Almost all the home builders, the ones we own, trade at below market multiples on this year's numbers [and] way below on next year's numbers. They have earnings growth much faster than the overall market," he said.

Miller likes autos as well, although not as much as home builders at the moment. He called the stocks "very cheap" and said the high number of recalls right now has very little to do with overall auto demand for the next 2 to 3 years.

"Unless there's actually a contraction in auto demand or if GM were to lose market share on a more permanent basis, that would be cause for concern," he said.

—By CNBC's Michelle Fox

Disclosure: Bill Miller owns Amazon,Apple, Ford, GM, and Fiat Chrysler.