What's the opposite of a financial crisis? We may be about to find out.

Amid the flurry of headlines already reinforcing how different the American landscape is five years on from the Great Recession – to wit, historic job growth, record-high household wealth and a bidding war over Jimmy Dean sausages – perhaps the most telling development didn't make headlines last week.

It's a bit wonky, sure, but it's also important.

Read MoreRate hike depends on 'tight' economy: Fed's Powell

It's one of those so-called 'leading' indicators that investors watch to gauge the health and future direction of markets: the cost of insuring major U.S. financial firms against default.

This plunged last week. The cost of protecting Goldman Sachs, for instance, has fallen by half since October. It dropped by around 20 percent so far in June alone. Intuitively, brighter prospects for the nation's leading financial firms augur well for the broader economy. More practically, it has also been a key leading gauge of stock-market performance "for the last two up-and-down cycles," according to market analyst Brian Reynolds of Rosenblatt Securities.

"This is turning out to be one of the eight to twelve day periods of my 30-year career that will be indelibly burned into my brain," he said on Friday, referring to the credit market moves on Goldman and its peers.

Read MoreUS economy: Where is the money?

Does this "melt-up" of apparent creditworthiness signal a looming "melt-up" in stocks even as the Dow Jones Industrial Average and the S&P 500 have already more than doubled from their 2009 lows and are currently trading at all-time highs?

Well, if past is prologue and behavior in these credit-market metrics is any guide, "This is the opposite of June 2008," said Mr. Reynolds, referring to the meltdown then of credit markets (and stocks, which followed suit).

Read MoreComplacent markets: something to worry about?

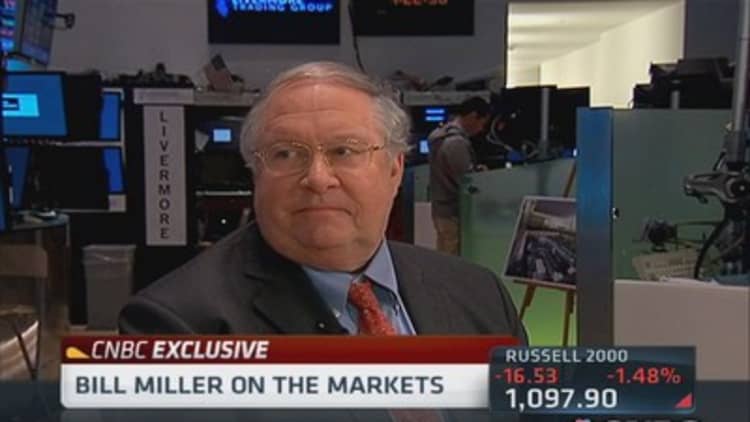

Mr. Reynolds isn't the only one who has defied the bearishness that many traders and hedge-fund managers have repeatedly banked on this year. In April, Legg Mason's Bill Miller told CNBC that "you could shoot a dart at the stock market and anything you hit will be [trading] higher in six months," adding the usual conditions for a bad market – slowing growth, or rising interest rates – "simply don't exist."

When asked about his biggest stock market concern Mr. Miller said it was a market "melt-up" in the second half of this year as bearish investors capitulated. Any parabolic move higher as a result could create instability and undermine the health of a steadier market, he cautioned.

So it's perhaps both a welcome and wary development that one of the country's biggest hedge-fund managers on Thursday told CNBC that his fears about the stock market – outlined at an industry conference just weeks earlier – have been largely "alleviated."

Read MoreAppaloosa's Tepper:Chief market concerns have 'alleviated'

David Tepper, of Appaloosa Capital Management with roughly $15 billion in assets under management, has become something of an investment barometer after a series of successful market calls in recent years. In mid-May, he said it was "nervous-time." His ensuing relief came last week after the European Central Bank for once did more, rather than less, than most were expecting to stave off deflation across the euro zone.

Whether or not Europe's economy can gather lasting momentum remains in question, especially as the threat of a euro zone break-up looms large. The U.S. economy meanwhile has just recorded its first four-month stretch of adding 200,000 jobs or more each month since 1999.

Read MoreUkraine:Why markets should (still) be worried

U.S. fundamentals are still solid, and as Friday's jobs report showed, perhaps surprisingly so. That may explain the recent capitulation of many macro bears and parts of the credit market. If so, this could be a key juncture for the next leg of the stock-market rally.

It's key for another important reason too, however: preventing – if such prevention is possible – another all-too-devastating breakout of asset-price mania.

Read MoreWhat market prosexpect Draghi and the ECB to do

Paul McCulley, who recently returned to Pimco as the bond giant's chief economist, told CNBC last week he's already worried about excess in parts of the real estate and stock markets. Meanwhile, Cantor Fitzgerald CEO Howard Lutnick said he believes low rates will spur further gains especially in real estate for several more years, and has instructed his brokerage firm to pour more resources into its fast-growing commercial property lending business.

If we are truly at a moment today that, in Mr. Reynold's cheeky nod to social media, he has dubbed the #anti2008, then these areas are among the most important ones to watch.