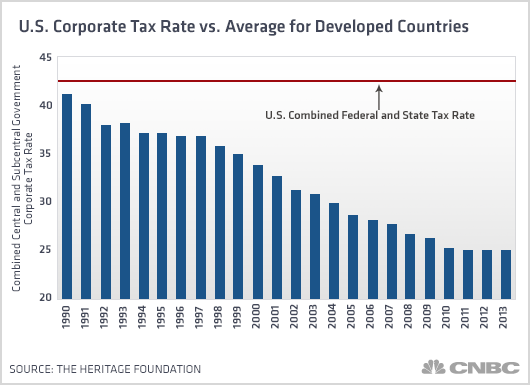

Because most developed countries have lowered their tax rates to the mid-20-percent range to attract business while the U.S. rate remains unchanged, there is an increasingly large cost for U.S.-domiciled companies to bring foreign-generated earnings to the U.S. Having to pay those costs puts U.S.-domiciled companies at a competitive disadvantage when it comes to efficiently allocating resources in an increasingly global economy. On the international playing field, the company with the lowest costs (including taxes) is in a competitively superior position as it can charge less for its products while dedicating more to research and development or other capital projects.

Many small companies and start-ups incorporate in the U.S. and then are stuck when they succeed and grow into international operations with an unanticipated competitive disadvantage. What message would Secretary Lew's version of "economic patriotism" send to future entrepreneurs with a choice of where to locate and the possibility of being held hostage due to an early decision to domicile their business in the U.S.?

Read MoreOpinion: Stop trying to force companies to stay in the US

Saying, as Secretary Lew does, that companies need to be more patriotic so that "we all rise or fall together" ignores economic reality. Putting American companies at a competitive disadvantage just ensures that we all fall together. Why place U.S. companies at a competitive disadvantage and why would a company that competes internationally choose to domicile here if our tax system puts it at a competitive disadvantage?

We're a great country but we're no longer the only game in town. In fact, as our government has grown ever more intrusive, we've become a less desirable place to locate. The Heritage Foundation / Wall Street Journal 2014 Index of Economic Freedom, ranked the U.S. as the 12th most economically free nation in the world, down from 5th in 2008. Companies are increasingly global in nature and able to locate in other places. It's incumbent on our government to wake up and give businesses reasons to remain rather than complain that they're increasingly voting with their feet.

As Secretary Lew noted, "the best way to address this situation is through business-tax reform that lowers the corporate tax rate, broadens the base, closes corporate loopholes and simplifies the tax system." That's hard to argue with. Rather than building a regulatory wall around America, let's update the tax code to be consistent with the competitive realities of a modern world. There are proposals out there.

Read MoreKing George III applauds Jack Lew's tax remarks

The bipartisan Simpson-Bowles Commission recommended that the government adopt a competitive territorial tax system "[t]o bring the U.S. system more in line with our international trading partners." House Ways and Means Committee Chairman Dave Camp also proposed legislation that would move the U.S. to a territorial tax system and reduce the maximum corporate tax rate to 25 percent. An update could eliminate the competitive disadvantages of the current system while limiting corporate tax avoidance and deferral. It would be good for the American economy, American businesses and the American people.

If U.S.-domiciled companies repatriate their foreign earning and invest in research and development or other capital projects, it will create jobs. Even if they elect to pay dividends, shareholders will both pay taxes on those dividends and have more money to spend generating economic growth. If they repurchase shares, the government will tax capital gains on the profits of shareholders who sell their shares as well as future capital gains on the increased value of the remaining shares.

Otherwise, U.S.-domiciled companies will keep and invest their foreign earnings in foreign markets to remain competitive and avoid or defer tax liability. Prohibiting them for moving to a foreign domicile won't change that. A tax so punitive that it's consistently avoided serves no rational purpose.

Commentary by Andrew F. Puzder, CEO of CKE Restaurants Holdings. which owns Hardee's and Carl's Jr. He co-authored the book "Job Creation: How it Really Works and Why Government Doesn't Understand It." Follow him on Twitter @AndyPuzder.