America's small-business owners are wealth builders, driving GDP and job growth. But when it comes to their personal finances, they get low marks in asset diversification and retirement planning. That's because the vast majority of their invested wealth is tied up in their businesses, a tactic that is shortchanging their personal financial futures. These findings were revealed in the first CNBC/FPA Small Business and Financial Planning Survey, released today.

The survey, conducted in conjunction with the Financial Planning Association, sampled 178 financial advisors nationwide that service small-business clients ages 35 to 70.

A whopping 70 percent of small-business owners' wealth is invested in their business, and only 30 percent outside their firms, according to the survey. Assets they are investing in are stocks (89 percent), real estate (64 percent), bonds (63 percent), commodities (19 percent) and other sectors.

The most pressing financial challenge facing small-business clients today is developing a retirement plan and exit strategy (42 percent). That's followed by managing cash flow (23 percent), business tax issues (14 percent), health insurance (6 percent) and raising working capital (6 percent). Other issues cited include growing revenues and succession planning.

Despite these concerns, less than one-third of small-business clients worked with their advisor on a business plan, the CNBC/FPA survey revealed. Of those that do, only 25 percent met with their advisor to review their plan quarterly. Seventy-two percent met with their FA annually.

Among those that have retirement plans in place, the most popular vehicles among small-business clients polled are profit sharing 401(k)s (54 percent), followed by SEP IRAs (19 percent) and SIMPLE IRAs (12 percent.)

Read MoreFear running short of cash in retirement? What to do

"Small-business owners are very myopic and tend to focus on the viability and growth of their business, ignoring much else, including their long-term financial needs," said Michael Branham, a certified financial planner who is chairman of the FPA and president of Cornerstone Wealth Advisors in Minneapolis, Minnesota, a firm with about $200 million of assets under management that services small-business owners. "There needs to be balance between their personal and professional money goals."

Leslie Beck, a certified financial planner that runs Compass Wealth Management in Maplewood, New Jersey, a firm that services small health practitioners and other small businesses, agreed. "Most of my clients have their business and personal finances so intertwined they cannot untangle what is what so they can analyze their broad financial picture."

Work-life financial balance

Neglecting a personal financial investment strategy and just plowing money into a business is fraught with risk. "It means the only way to fund retirement is to sell and cash out," explained David Yeske, a principal in Yeske Buie, a financial advisory firm with offices in San Francisco and Vienna, Virgina. "There is always uncertainty on how successful the owner will be in finding a buyer at the right price. If he or she dies before this is accomplished, all can be lost."

Read More11 common reasons small businesses fail

The CNBC/FPA survey highlighted that most advisors servicing small-business owners had the same concern. Over half of the respondents, 54 percent, felt their small-business owner clients did not have enough protection against financial risks, and 19 percent were not sure. Twenty-eight percent felt their clients were well protected.

The immediate risks involve the owner's disability or premature death, which would leave the businesses subject to liquidation at fire-sale prices, or possibly dissolution, leaving the owner's family with little or nothing.

Crafting a grand exit

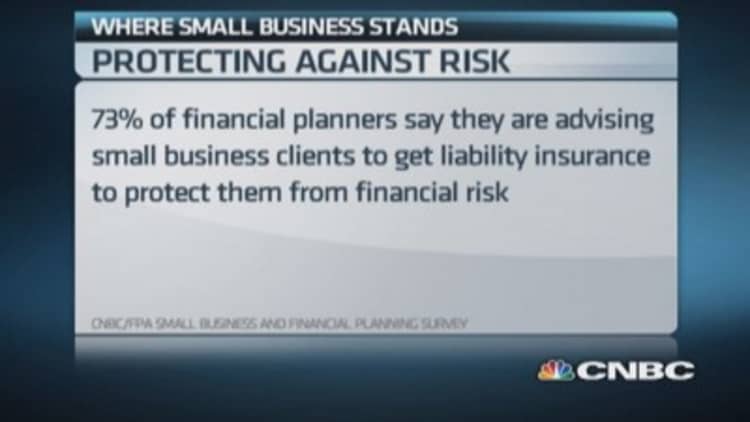

To mitigate risk for small-business owners, financial advisors are using an array of insurance products, the survey showed. Disability insurance was employed by 81 percent of respondents, followed by liability insurance (73 percent), key man insurance (70 percent), health insurance (63 percent), property/casualty insurance (56 percent) and business-interruption insurance (37 percent).

Despite this fact, 47 percent of FAs who took the survey noted that only up to 20 percent of their clients had any succession plan in place to ensure a smooth management transition.

Read More6 steps to foolproofing a retirement portfolio

This is a hot-button issue. "It's hard for a business owner to think about turning over the reins of the business to someone else," said Cornerstone Wealth's Branham. "Their personal identity is tied to their company. As a result, they don't adequately prepare an exit strategy."

According to the survey, 31 percent of small-business owners say the biggest hurdle they must overcome when creating an exit strategy is finding a buyer. Other major concerns: valuing the business (23 percent), the emotional toll (21 percent), determining what to do next (13 percent) and figuring out retirement (8 percent).

Financial advisors who participated in the CNBC/FPA survey pointed to three key initiatives small-business owners and their financial planners should follow in order to secure their financial future.

1. Diversify. Work to reduce dependence on the eventual sale of the business to fund retirement. Instead, strike a balance between reinvesting all profits in business expansion and diverting some funds to other investment assets.

2. Prepare for the worst. Protect your family and your business assets by buying insurance that covers the business owner's disability or premature death.

3. Plan for succession. The time for a business owner to start developing a succession plan or exit strategy is from the first day the firm is launched. That's because a well-designed strategy—including grooming the right individuals for succession—may take years or decades to implement.

The good news is, there is usually a fallout benefit. As Yeske pointed out, "Having a smart exit strategy boosts the odds of a small business's long-term success, since it guides the founder on how the business should be properly structured and managed on a day-to-day basis."

—By Lori Ioannou, senior editor, CNBC.com