Weak economic data and a downbeat central bank statement dampened sentiment towards the Australian dollar recently, but one analyst told CNBC investors shouldn't give up faith.

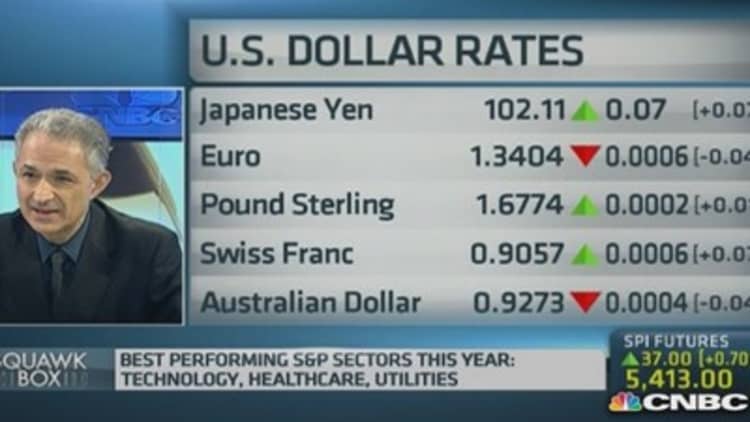

The currency fell 2.6 percent from its July 1 year-to-date high of $0.9504 against the U.S. dollar to a two-month low of around $0.9236 last week amid rising unemployment and a weaker growth outlook.

Australia's July unemployment rate unexpectedly rose to 12-year high of 6.4 percent, triggering concerns about the economy. Meanwhile, the Reserve Bank of Australia (RBA) downgraded its 2014 growth projection to 2.5 percent from 2.75 percent, its 2015 forecast to 2-3 percent from 2.25-3.25 percent and trimmed its inflation forecast to 2.25 percent from 2.5 percent.

Read MoreAustralia central bank holds rates at 2.5%

But Andrew Freris, CEO at Hong Kong based investment advisory firm Ecognosis Advisory, is not concerned: "It's still potentially the best carry currency anywhere in the world."

"That's why I never lose faith the Aussie despite all the clearing of throats at the Reserve Bank of Australia trying to talk it down," he added.

Carry trades involve borrowing in a low-yielding currency to fund investments in higher-yielding assets elsewhere. The trade is popular amid record-low interest rates in developed economies like the U.S., Japan and the euro zone.

Interest rates in Australia, on the other hand, currently stand at an attractive 2.5 percent, despite having been cut eight times over the past two-and-a-half years.

Freris said that in some ways the Australian dollar offers a much more attractive investment that U.S. government bonds.

Read MoreAustralia central bank sticks to low rate stance

"The Aussie overnight rate is yielding 2.45 percent, and the U.S. ten-year bond gives you 2.4 percent... This is what I tell my clients - I say 'you want to wait 10 years to get 2.4 percent, put it on the Aussie and you get it overnight," he said referring to the annual interest investors would earn by holding their cash in Australian banks.

By contrast, U.S. ten-year bonds generate a similar level of interest with an annual rate around 2.4 percent, but investors will have to wait ten years to get it.

"Yes, you get an exchange rate risk against the U.S. dollar but you'll get the same problem if yields begin to rise quickly in the U.S. and you lose money on the price," he added.

Headwinds abound

Other analysts are more bearish on the Australian dollar.

"We think for the Aussie dollar, fair value... is in the mid-80s [cents]," said Malcolm Wood, head of investment strategy at Morgan Stanley Wealth Management, referring to a 13.5 percent drop against the greenback from its current value.

"[RBA Governor] Glenn Stevens said a few weeks ago that 'the Aussie dollar is overvalued and not by a few cents' and we endorse that view. And as we move forward with this gap narrowing between us and the U.S., fair value will move towards $0.80," he added.

Read MoreAustralia jobless rate jumps to 12-year high

According to Wood, the RBA's next move could be to cut rates given weakness in the economy, which would reduce the Aussie's yield, making it a less attractive carry trade.

"Wind the clock forward to mid-next year when the [Federal Reserve] is expected to raise interest rates and we think the gap between two-year rates in Australia and the U.S. could be down to between 50 and 100 basis points, which is low by historic standards, and that will help drive the Aussie down," he added.