European shares ended the day in the green on Thursday, despite some disappointing data from the euro zone, as investors focused on central bank monetary policy.

PMIs released

The pan-European FTSEurofirst 300 closed up around 0.6 percent at 1,354.68 points. It followed some fluctuation earlier, as investors digested the flash composite Purchasing Managers' Index (PMI) for the euro zone.

The flash estimate fell to 52.8 in August, below the forecasted 53.4, where a reading above 50 indicates expansion. Analysts expressed relief that the data was not worse, and noted that the figures for France indicated that business activity had started to stabilize after contracting in previous months.

European markets

Germany's DAX closed up around 0.9 percent, while France's Cac beat most other European bourses to end the day 1.2 percent higher.

Read MoreEuro zone business activity slips, missing forecasts

Raiffeisen climbs

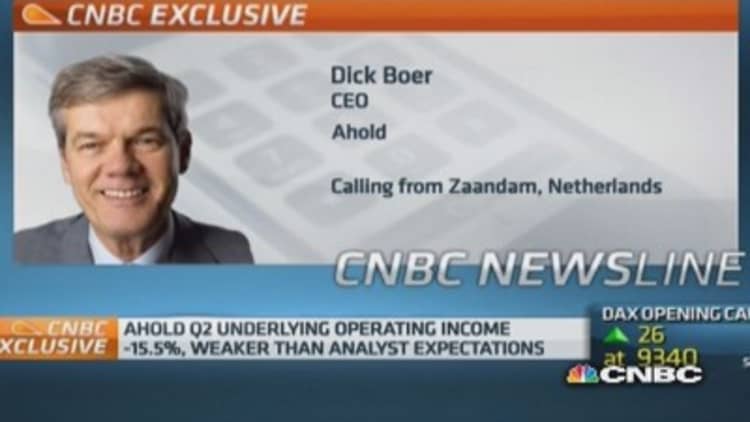

In stocks news, Dutch company Ahold saw its shares fall to end the day down around 0.9 percent after the supermarket group reported weakness at its U.S. unit. The company owns the Stop & Shop chain in America, and said like-for-like sales had fallen 1.8 percent in the latest quarter.

Shares of Austrian bank Raiffeisen climbed over 11 percent after the lender reported better-than-expected earnings and said that it was not currently experiencing any major impact from Russian sanctions.

Meanwhile, the U.K.'s Premier Oil fluctuated before closing down around 1.8 percent after the oil and gas explorer posted a 7 percent rise in first-half profit and highlighted an increase in production at its British oil fields.

Also in the U.K., retail sales grew at a slower pace than expected in July, according to official data.

Yellen speech eyed

In the U.S., stocks climbed on Thursday, with the S&P 500 toppling a record, as investors embraced upbeat economic reports and looked to a dovish message from Federal Reserve Chair Janet Yellen when she talks about the labor market in Jackson Hole on Friday. It comes after the Fed minutes from July's policy meeting, published Wednesday, were more hawkish than some expected.

Read MoreEl-Erian:Fed minutes more hawkish than expected

Meanwhile in Asia, stocks were mixed, with Chinese shares significantly lower on the back of a lower-than-expected preliminary reading of mainland manufacturing activity. The basic resources sector in Europe - which has heavy exposure to the country - was a laggard for European bourses on Thursday.

Read MoreChina's factory activity falls to 3-month low

Traders across the globe will be watching the central bankers gathered in Jackson Hole. Yellen and European Central Bank (ECB) President Mario Draghi are just two of the central bankers due to speak at the event, and market participants will be keen to monitor any hints at future monetary policy.