European shares closed flat-to-higher on Wednesday as investors considered the possibility of more monetary easing in the euro zone.

The pan-European FTSEurofirst 300 closed provisionally 0.1 percent higher at 1,378.2 points. During the session it traded in low volumes in a tight range, as investors took a breather after two days of strong gains.

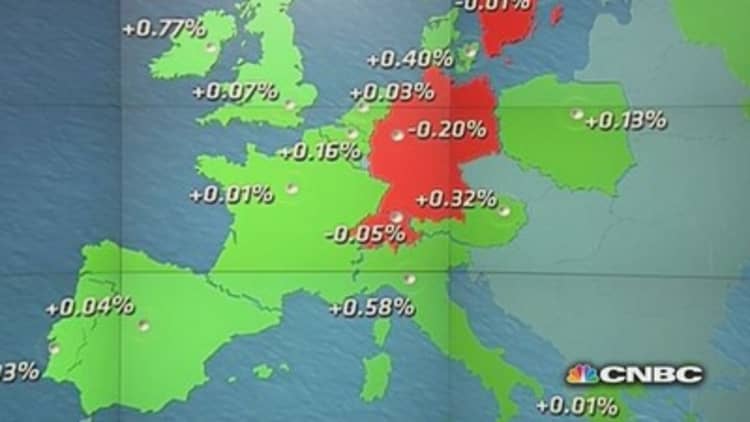

The U.K.'s FTSE 100 index closed unofficially up 0.1 percent. The France's CAC 40 ended flat and the German DAX was unofficially down 0.2 percent.

European markets

Investors continued to mull whether or not more stimulus measures could be announced when the European Central Bank (ECB) next meets. Germany's Finance Minister Wolfgang Schaeuble reportedly told a newspaper on Wednesday that remarks by ECB President Mario Draghi had been "over-interpreted" to suggest imminent new measures.

German consumers wary

A German consumer climate survey showed a fall in morale for the first time in more than 1-and-a-1/2 years. Forward-looking data from market research group GfK showed consumer confidence at 8.6 in September, down from 8.9 in August.

Read MoreGerman shoppers grow wary, consumer morale drops

In stock news, shares of Asos surged to close over 19 percent higher after unconfirmed reports that the online retailer was receiving interest from a U.S. bidder.

Telecom firms rose to the top of benchmarks on reports that Brazil's Grupo Oi might buy the Brazilian unit of Telecom Italia. Telecom Italia's shares closed up around 3.2 percent.

Grupo Oi's partner Portugal Telecom was also boosted, with its shares closing sharply higher by around 6.3 percent. This in turn boosted the benchmark Portuguese PSI 20, which closed up nearly 2 percent.

U.S. stocks wavered on Wednesday, a day after the 's first close above 2,000.

Follow us on Twitter: @CNBCWorld