European shares closed flat to lower on Monday as investors weighed worse-than-expected manufacturing data against tensions in Ukraine.

Most major country bourses closed down, but volumes were light because of U.S. markets being shut for Labor Day.

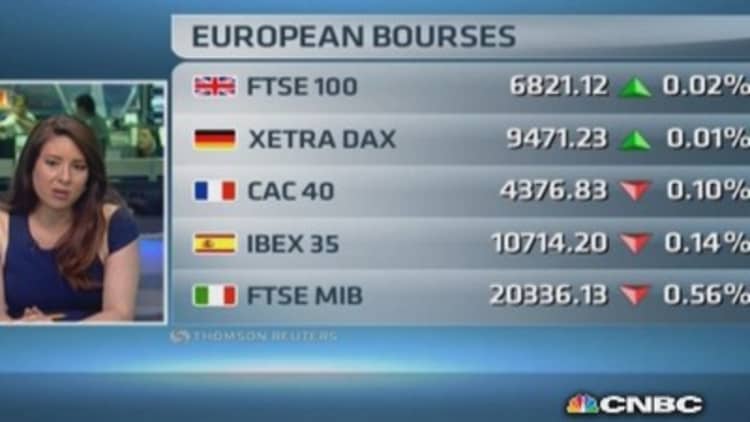

The U.K.'s benchmark FTSE 100 and the German DAX both provisionally closed flat, while the French CAC ended unofficially lower by 0.1 percent.

The exception to the downward trend was the Swiss Market Index (SMI), which closed around 1 percent higher. The benchmark index was boosted by a rise in shares of Novartis, which released promising data regarding a new drug to treat heart disease. The pharmaceutical giant's shares ended roughly 4.3 percent higher.

European markets

Earlier in the session, data for the euro zone showed growth in manufacturing output slipped in August, as economic and geopolitical uncertainties hit demand. Markit's purchasing managers' index (PMI) fell to 50.7, down from 51.8 in July.

In the U.K., manufacturing growth also slowed in August, with the index reading 52.5, down from 54.8 in July.

Read MoreEuro zone manufacturing slows to 13-month low

Meanwhile, a full breakdown of German gross domestic product confirmed that the economy contracted by 0.2 percent in the second quarter.

Ukraine weighs

Russian troops continued to make incursions into the east of Ukraine on Monday, as Ukrainian President Petro Poroshenko accused Moscow of "direct and open aggression".

Read MoreUkraine: The struggle between hard and soft power

Over the weekend, Reuters reported that pro-Russian separatists had gained ground against Ukrainian forces. The rebels claim to have fired on a Ukrainian vessel in the Azov Sea.

M&A rumors hit Iliad, ITV

In individual stocks news, Iliad plummeted to close around 8.8 percent lower on reports that the French low-cost telecom operator may up its bid for T-Mobile US.

However, shares of ITV closed roughly 3.6 percent higher, on speculation that Liberty Global was about to launch a bid for the U.K. broadcaster.

Shares of French multinational advertising firm Havas gained around 1.2 percent, after upgrades from two investment banks.

Tesco shares closed around 1.9 percent lower after the supermarket chain was downgraded and one of its largest shareholders, Harris Associates, sold two-thirds of its stake in the company. Shares closed around 0.5 percent higher.

Read MoreTesco: Might more investors check out?

Late in the day, Italy's Luxottica reported that Chief Executive Andrea Guerra was stepping down and being replaced by a new management structure comprising three top executives.

The European Central Bank (ECB) is set to meet later in the week and some analysts are anticipating the announcement of further monetary stimulus measures.

"Analysts are quite split this week on what Thursday's ECB meeting will deliver. Some are tipping an ECB rate cut and others are eyeing a stimulus package, while the rest aren't expecting action just yet," Stan Shamu, a market strategist at IG Markets, said in a note.