The dynamics in the market are changing. And Cramer says investors need to change, accordingly.

Largely the Mad Money host believes that will likely command the market's attention, on almost a daily basis, with investors closely watching each and every development.

Because published reports are saying the conflict could potentially become Europe's worst crisis since World War II, Cramer believes the market will make very clear distinctions among stocks, penalizing stocks that could be hurt by negative developments and rewarding those that remain, largely, unaffected.

The Losers

Given circumstances, Cramer sees money rotating out of multinationals, especially those with significant European exposure. Therefore, he's skeptical of big industrial giants as well as many global technology companies.

Also, Cramer believes the conflict will likely send more money into US Treasurys, which should keep rates low. In turn, Cramer is looking for the greenback to remain strong relative to other currencies. "That's terrible for banks because it keeps our rates too low for them to make big profits. It's awful for our consumer packaged goods and our international drug stocks because they need a weak dollar to beat estimates as they have to translate their profits into dollars for the purposes of earnings per share calculations.

All told, given the broad environment, Cramer is skeptical of global companies that are in the industrial, technology, financial services and health care sectors; he thinks many of them could all be facing serious challenges.

The Winners

Again, Cramer believes companies with little to no exposure to the crisis in Ukraine, or the resulting ripple in Europe, are most likely to attract investment.

"Therefore, through the end of the year, I am pegging Twitter, GoPro, Tesla and Netflix as the four stocks that investors will find irresistible," Cramer said.

Not only are they relatively isolated from overseas woes, but Cramer says they each have specific catalysts that should drive gains.

"Twitter's turned the corner ever since CFO Anthony Noto got there to add discipline and ways to make money. GoPro's got an eco-system with the hottest product for the holiday season and we always jump that gun in September. Tesla's just a really well-run company, and unlike the other car companies I follow, it is almost all domestic. And, As more movies are added to streaming and more productions come on line I can see Netflix powering higher.

If the stocks outlined above aren't for you, Cramer has many other ideas.

As long as prices at the pump stay relatively low and the economy continues to improve, Cramer thinks best of breed restaurants and retailers could go higher. In retail Cramer cited Ross Stores and Macy's as two stocks to watch. Also, he said, "Home Depot, is a triumph of management, and, also an almost totally domestic story." In restaurants, "I'd play a game of high and low: Chipotle and Jack in the Box with its Qdoba kicker," Cramer said.

Elsewhere in the market, Cramer believes domestic health care companies will also attract money. "I see so much to like in health care that it's just plain remarkable. Anything hospital, anything; I believe Tenet and HCA are going to be go-to stocks for money manager from now until year-end. Also McKesson, CVS and Cigna merit attention," Cramer said.

In addition, Cramer can see shares of Regeneron, Gilead and Celgene all rallying, "as the ultimate Ukraine immune plays."

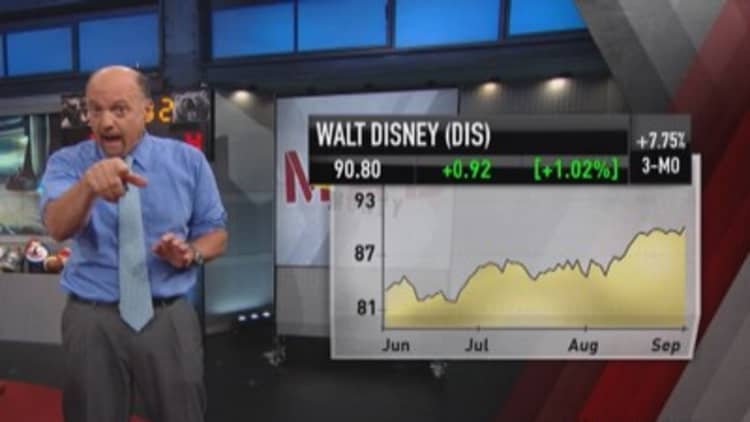

Also, Cramer is bullish on Disney with the new "Star Wars" film scheduled to come out next year.

He also likes, Automatic Data as a continued play on return to employment growth, as well as Waste Management, "due to gains in construction." I also like Constellation Brands and Monster Beverage as the food and beverage plays," Cramer said.

-------------------------------------------------------------

Read more from Mad Money with Jim Cramer

Self-critical, Cramer reveals big stock regret

Cramer's draconian rule that really drives profits

Despite new highs, Cramer spots a bargain stock

-------------------------------------------------------------

All told, Cramer sees many ways in which to navigate the tensions overseas. But make no mistake, navigate you must. "You have to switch your gameplan to preserve your gains," Cramer said. Stocks that performed well in the first half of the year may not do well now.

(Click for video of this Mad Money segment)

Call Cramer: 1-800-743-CNBC

Questions for Cramer? madmoney@cnbc.com

Questions, comments, suggestions for the "Mad Money" website? madcap@cnbc.com