European shares closed flat to lower on Friday, as investors monitored developments in Russia and Scotland, and looked ahead to an important U.S. Federal Reserve meeting next week.

The pan-European FTSEurofirst 300 closed provisionally 0.1 percent lower at 1383. It was just under 1 percent lower on the week.

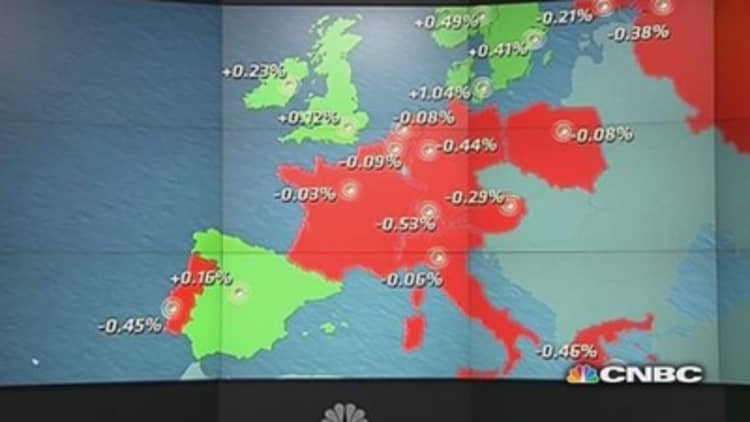

European markets

The French CAC 40 ended roughly flat while the German DAX ended provisionally 0.4 percent lower.

The U.K. FTSE 100 outperformed to close unofficially 0.1 percent higher, after a new YouGov poll showed Scottish voters were edging towards a "no" vote in next Thursday's independence vote.

Wall Street stocks opened lower on Friday, as investors around the world mulled when the Fed might start hiking interest rates.

"Global equities seem to be in a holding pattern as we head into next week's Federal Open Market Committee (FOMC) meeting," Stan Shamu, a market strategist at brokerage IG Markets said in a research note.

In addition, the Europe and U.S. implemented new rounds of sanctions against Russia on Friday.

Europe's new sanctions include further restricting access to foreign capital for Russia's largest state-controlled companies, including top energy firms. Also, leading Russian politicians were hit with foreign asset freezes and travel bans.

The U.S. announced sanctions against Russia's largest bank, , as well as several state-owned defense technology companies and five energy companies.

Aveva shares plummet

U.K.-listed Aveva shares tanked to close around 25 percent lower after the software company warned its first-half results has been affected by currency fluctuations.

U.K. shares of oil major BP spiked by 5 percent briefly at around midday London time, which traders blamed on a "fat finger" error. Shortly afterwards, shares fell back and later closed around 0.4 percent lower.

Read MoreMarc Faber: McDonald's shows bear market is coming

Shares of Danish pharma company Novo Nordisk closed up around 2.7 percent on the news that it had received a positive recommendation on a new obesity drug in development.

Follow us on Twitter: @CNBCWorld