The Federal Reserve remains concerned enough to keep interest rates very low for a "considerable time" after it finishes its asset purchases. I can't say I'm too surprised. Although I believe it's far past time that the Fed get out of the way, sufficient cover remains for the Fed to keep the pedal to the metal. Most notably, the middle class continues to suffer from a stubbornly weak labor market.

This week, the Census Bureau reported that median household income in 2013 was still just slightly above the 1995 level. As expected, there was very little improvement from the 2012 level.

Read MoreIs the guy next to you flashing a sell signal?

I guess we should be somewhat gratified that inflation-adjusted incomes have stopped going down, but increases such as the one reported for 2013 are unlikely to provide the means to spend at noticeably higher rates. Spending by rich people as a result of stock gains is not enough to move the needle for the whole economy. We need to see more widespread income growth before spending picks up steam.

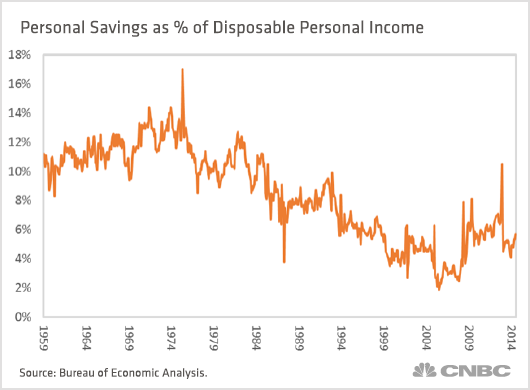

Aside from insufficient job growth and very low income growth, another obstacle to near-term economic growth appears to be emerging. For several years now we have been arguing that the consumer (and especially baby boomers) continues to carry too much debt and is ill-prepared for retirement. We have said that we, collectively speaking, need to continue the process of paying down debt while saving more for retirement. Well, it looks like we are getting what we asked for. The latest reading for the consumer savings rate (July) tells us that consumers are saving 5.7 percent of disposable income. While this figure remains well below the long-term average of about 8.4 percent (since 1959), it is also well above the low of 1.9 percent in July, 2005. And the trend is clearly up.

Read MoreOp-ed: Two big problems in the job market

What are the implications of a higher savings rate? Well, obviously, if consumers are saving more, they are spending less. And while this is a good thing for the long-term health of the economy, it does not bode well for more near-term growth prospects.

Is there a silver lining in all the income data? Yes. In fact, there are several.

The consumer is seeing some relief from lower interest rates, which shot up dramatically last year on fears that the Fed was done with quantitative easing. This should help support residential real estate activity as well as some other forms of consumer borrowing. Second, we have begun to experience a meaningful decrease in prices for gas, food, and other commodities. Some of the decreases can be attributed to weak global demand (outside the U.S.), and some can be attributed to the recent strength in the dollar. In any case, lower prices for necessities should free up income that can be spent elsewhere. And finally, consumer credit has begun to pick up as banks start to loosen their lending standards. Although most of the growth has come from student loans and auto loans (for both of which we have our concerns), revolving credit (read: credit cards) has begun to pick up as well. This bodes well for consumer spending.

Read MoreFall gas prices could hit a four-year low

It's hard to say which of these competing forces will win out over the next couple of years. At this point, most professional investors seem to be operating under the old saw, "Don't bet against the U.S. consumer." Personally, I don't think it makes sense to celebrate the fact that consumers are yet again (with the Fed's strong encouragement) willing to take on more debt. I believe the savings rate needs to go even higher and stay there for some time. This will be a drag on economic growth for a while, but it will be in the long-term best interests of our economy.

The bigger point here is that, because we are so dependent on consumer spending, there is a ceiling to how fast the economy can grow. Spending and investing that is taking place now could quickly evaporate in the event of higher interest rates. It is safe to assume that interest rates are not going to remain this low forever. It needs to be recognized that this is the price we must pay for evading the kind of deep, harsh recession that would have put many more people out of work. The Fed eased the severity of the recession, but the tradeoff is a protracted period of sub-par growth. Anyone expecting otherwise is likely to be proven wrong. It's time to pay the piper.

Commentary by Michael K. Farr, president of Farr, Miller & Washington and a CNBC contributor.