Believe it or not, there have been plenty of ways to make money in the market, other than the Alibaba IPO. You wouldn't have known it in the last week, with the offering sparking a frenzy rarely seen on Wall Street. However, in the week ahead, Cramer expects to see pros settle in and return to business as usual; that is, finding stocks with catalysts and putting money to work accordingly.

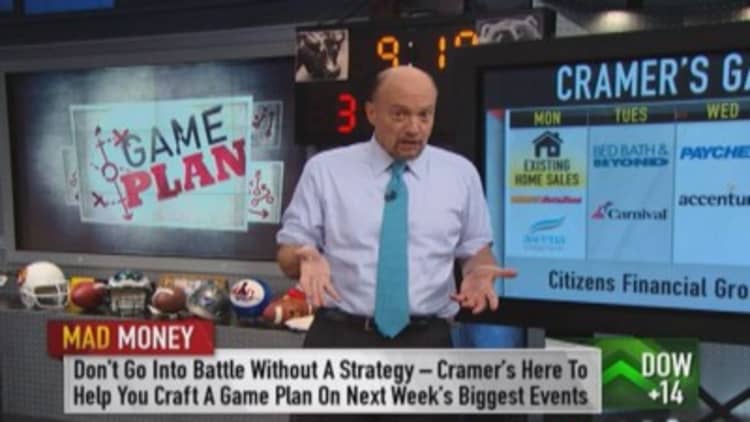

Following are the events on his calendar.

Mon., Sept. 22

On Monday, Cramer will be eagerly anticipating existing homes sales data. "I will be paying close attention to this number because I want to know if the economy is slowing," Cramer said, and this number could provide valuable insights. "I would love to see some sort of number that tells us the recent dip in interest rates spurred sales, but I bet we don't get it."

Also Cramer will be listening to results from AutoZone. "This company has a history of reporting, then selling off, and rallying again. Given there are so many older cars on the road that need Autozone, I'd buy the dip."

In addition, Cramer will be following results from from Ascena, the retailer formerly known as Dress Barn. "I consider Ascena to be a lot like Ross Stores or TJX or Kohl's, all of which are having a resurgence. I wonder if this quarter won't show the same kind of upside surprise. If so, it's a buy."

Tues., Sept. 23

On Tuesday, Cramer will turn his attention to earnings from Bed Bath & Beyond. "I expect nothing good, although there is a lot of chatter that it might attract private equity money because it's gotten too cheap to stay public."

Also Cramer will be watching results from Carnival. "This cruise line's stock has been going up with the rest of the players in the sector as if the tragedies are, at last, behind them. If we get a decent number I don't think the rally stops."

In addition, Cramer will be sifting through the IPO of , formerly part of the Royal Bank of Scotland. "Banks have been red hot and while this is no Alibaba I bet we can make some money with it. I will give you the pricing parameters for where it might be a buy as we get closer to the deal."

Wed., Sept. 24

On Wednesday, Cramer will turn his attentions toward Paychex, a company he often watches as a "tell" on small business. "I believe that small business formation has taken another step down. Let's see if I'm right."

In addition, Cramer will be watching results from Accenture. "This is a stock that has had a history of disappointing, yet, like AutoZone, somehow finds itself above where it was before the next quarter is reported, a classic dip-bought equity."

Thurs., Sept. 25

On Thursday, Nike will command Cramer's attention, "It's a quality shoe maker, but there's a problem; this stock has run too much. I would sell half ahead of the quarter."

----------------------------------------------------------

Read more from Mad Money with Jim Cramer

Cramer: This is how you bottle Alibaba's magic

Screwed up firm ultimately worthless?

Cramer blesses a controversial stock

----------------------------------------------------------

Also, Micron reports on the same day. "There's a real tug of war going on right now with Micron, and it doesn't involve demand, which is robust. It involves, potentially, too much supply from Korea, where there are two other companies that make the same kind of semiconductors. I haven't liked the action in this stock of late, and I would take a pass in the name."

Fri., Sept. 26

On Friday, Cramer will be all over BlackBerry's results. "I think that this company is in long-term decline accentuated and exacerbated by the new Apple iPhone. I would be very careful."

(Click for video of this Mad Money segment)

Call Cramer: 1-800-743-CNBC

Questions for Cramer? madmoney@cnbc.com

Questions, comments, suggestions for the "Mad Money" website? madcap@cnbc.com