Don't fear the "death cross," Ritholtz Wealth Management CEO Josh Brown said Tuesday.

"The old wives' tale is it signals a change in trend. And while that may be true, turns out if you're a trader with more than a 15-minute time horizon, not particularly relevant," he said. "There's no signal here."

A death cross occurs when a stock or index's 50-day moving average trend line dips below its 200-day moving average.

The bearish indicator appeared Monday in the Russell 2000, but most investors would do well to ignore the data point, Brown said.

Read More Time to worry? Russell 2000 hits 'death cross'

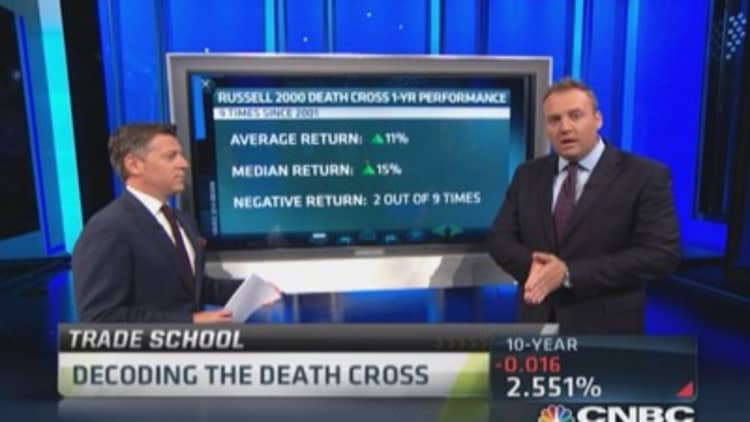

On CNBC's "Halftime Report," Brown said that looking at data going back to 2001, the average return on the Russell after a death cross was 11 percent after 12 months. The median return was 15 percent within the same time frame, and only two out of nine times was there a negative return, he added.

"Suffice it to say, I think this is the kind of thing that makes for really interesting blog posts, articles," Brown said. "It's very clickable. At the end of the day, it's not empirical. There's no reason why this should cause you to buy or sell."

Read MoreNo, Alibaba IPO doesn't signal a top: Pros

Brown added that he wasn't saying the Russell 2000 was buyable or at an attractive valuation.

"What I am suggesting is that this death cross phenomenon would not be a reason to hit the 'buy' or 'sell' button," he said.