Again, I have no idea how he was "unsuccessful." His Brookings representatives say he is "out of pocket and not commenting further." So let's speculate, shall we?

Maybe it was the recent job change. That's a red flag in the automated underwriting system. Maybe, being largely self-employed, he didn't want to disclose all his income from speeches and the book. Maybe he was trying to refi a jumbo loan, and he didn't have enough equity in the house. Or maybe, like me, he got a ridiculously inaccurate appraisal that tanked the process from the start.

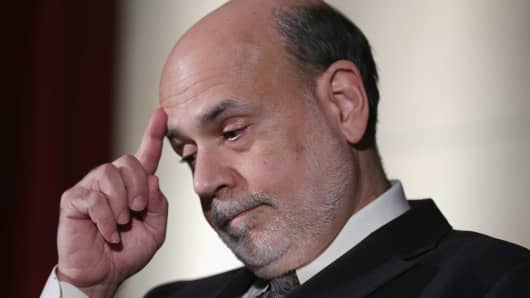

Read MoreBen Bernanke turned down for mortgage refinancing

I'm no Ben Bernanke, but I have a good job, employed at CNBC for over a decade. Yes, I have to give all my speeches for free, but I make a nice salary, and my husband is employed as well. We both have above average credit, and we had plenty of equity in our Washington home, which we purchased in 2003. So when we went to take out a home equity loan to re-do the kitchen, we figured it was a no brainer. Like Ben, we were mistaken—totally sympatico.

Our bank, which shall remain nameless, ordered what's called a "drive-by appraisal." Don't kid yourself, nobody drives by the house. Nobody even crossed the D.C. line. The appraisal of my home, in one of the District's most popular neighborhoods, where prices didn't crash during the crash, was done by someone near Baltimore, whose only visuals of my house were from pictures taken before I bought it, before I had put a large addition on the back, and before I had done a major outdoor renovation, including AstroTurf, basketball pad, side patio and a tree trapeze. (Sorry for the run-on there, but without the trapeze you really don't get the full value of the home.)

The report left out a bedroom and two bathrooms. It included none of the systems upgrades that had been done by the previous owner, who had gutted the 100-year old home just before we bought it, adding a high-end kitchen, central air, new pipes and a finished basement, to name a few things.

No surprise, the house appraised for less than we purchased it for 11 years ago. The guy didn't even check it out on Zillow. The appraisal tanked the loan. Does this sound familiar, Ben?

Read MoreUS mortgage activity remains stuck in neutral

For as many times as a real estate broker has told me that the housing market is just surging with pent-up demand, they've whispered to me on the side that appraisals are tanking deal after deal. After the housing crash, new rules for appraisals required that lenders use middlemen—appraisal management companies—in order to keep the process at arm's length. Arm's length is apparently north of Baltimore, for me at least.

Some today, including some bankers, claim that credit standards are loosening a bit, and necessary credit scores are coming down slightly, and it's easier to get a loan today than it has been since the credit crash; there are still clearly a few flies in the ointment.

As for me, I insisted the bank do another appraisal, an in-home appraisal. They agreed, and the home appraised at a value more than 20 percent higher. I got my loan. Ben, take note, and I'd be happy to explain it all over dinner in my new eat-in kitchen.

If a former Federal Reserve chairman and a (far lowlier) national business news reporter who covered the credit crash from start to, well, almost finish, don't sail through the mortgage process like Oracle's team in the America's Cup, something's not quite right.