The Reserve Bank of Australia (RBA) on Tuesday kept interest rates unchanged, but surprised some investors by not mentioning the Aussie dollar's recent slide.

As widely expected, the central bank held interest rates at a record low of 2.5 percent, where they have been since August last year, and maintained that it was "prudent to have a period of stability in rates."

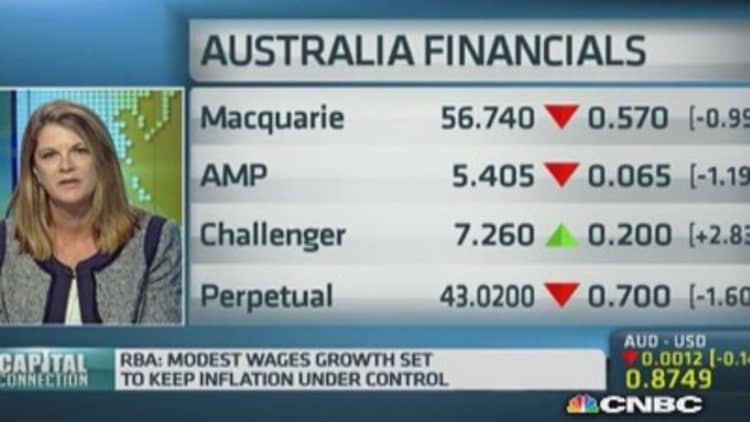

But the RBA said the Aussie dollar remained high by historical standards, despite the currency sliding more than 6 percent against the U.S. dollar in the last month, to trade at $0.8748 Tuesday.

Read MoreHave the Aussie dollar bears won the argument?

"The statement today is much more of a 'cut and paste' of recent months," said Annette Beacher, economist at TD Securities. "We were all looking for a phrase along the lines of a 'depreciation of the Australian dollar will help with the economy' [because] that's the phrase they used regularly... so that entire phrase or tone was missing today."

But Beacher acknowledged that it could be a deliberate strategy by the RBA, which has made no secret of its preference for a weak currency.

"The governor knows we watch every phrase so it could be a deliberate strategy not to talk about how low the currency is but to emphasize how high it is compared with commodity prices and historical norms," she said.

The Australian dollar has been on a backfoot in recent months amid a strengthening greenback as the U.S. Federal Reserve continues to tighten monetary policy.

Read MoreHave the Aussie dollar bears won the argument?

While the Aussie's rapid weakening may seem worrisome, it's still too strong by RBA standards, according to Paul Bloxham, chief economist for Australia and New Zealand at HSBC.

"We're still a touch above where the RBA is completely comfortable but they will think what's happened and the momentum in terms of the currency's downward movement is a pretty positive move," said Paul Bloxham, chief economist for Australia and New Zealand at HSBC.

"I think the fundamental value for the Aussie is between $0.80 and $0.85; that's where we're probably headed," he added.

Read MoreRBA warns of risk of 'unbalanced' housing sector

On the country's labor market, which added 121,000 jobs in August, the RBA says the data have been "unusually volatile," adding that it could be some time before unemployment falls consistently.

"We saw that super-sized number last month and we know it's rubbish really. From our own job ads, we are seeing consistent size of growth and the official numbers are probably lagging that," said Patrick Perret-Green, Senior Interest Rates Strategist at ANZ. "[However], we expect to see some improvement over the months."