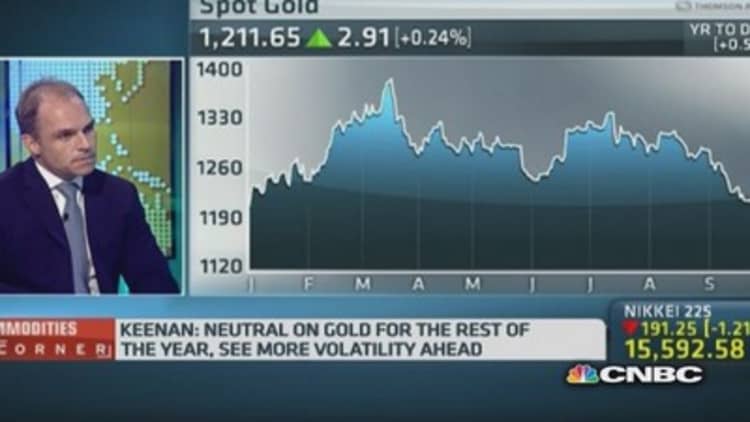

Gold's drop to 15-month lows may be timely for Asian buyers, but even an army of discount-hungry Indian matriarchs won't be enough to arrest the precious metal's slide in the fourth quarter amid the onslaught of the resurgent dollar, a CNBC survey of strategists and traders showed.

Almost two-thirds of respondents said gold has scope to fall further in the final quarter pressured by a surging U.S. dollar, while 35 percent believe the selling is overdone and prices will recover towards year-end as Asian physical demand returns.

"The death of the Asian gold market is greatly exaggerated," Mark O'Byrne, Founder and Executive Director of Dublin-based bullion dealer GoldCore, told CNBC in emailed comments. "Asian buyers have already begun coming back to the market and the latest data shows demand in India has picked up markedly and Chinese demand remains robust."

Read More'Nuanced' Q4 dollar gains as monetary policy diverges

Demand from buyers in India – the world's second-largest consumer after China – will reach a crescendo in the last two weeks of this month during the Hindu 'festival of lights' or Diwali which falls on October 23.

"Expect demand to increase when typically price-sensitive Asian buyers sense the market is hitting bottom," said Edmund C. Moy, chief strategist at California-based Fortress Gold and a former director of the United States Mint.

India tripled gold imports in August to just over $2 billion despite continued import restrictions. "Asian buyers have already started returning to the market," Moy said, though demand from China – now the world's leading buyer – looks less certain. "China's gold buying was set back because of a more robust anti-corruption campaign that references luxury gifts including gold."

$1,180 critical

But several forecasters contacted by CNBC were more skeptical, arguing Asian buyers were holding out for even lower prices before returning to the market.

"I expect buying in Asia to be weaker than last year due to forward buying that occurred due to the large price declines in 2013," said Anthem Blanchard, founder, president and CEO of Anthem Vault, a U.S.-based online precious metal retailer.

Meanwhile, gold bears UBS characterized Asian interest in gold as "moderate" despite the price drop. "The physical market is signaling that the gold price is not low enough to tempt many buyers," UBS strategists Dominic Schnider and Giovanni Staunovo said in comments emailed to CNBC.

"In order to balance the market and mop up expected additional supply coming from ETFs (Exchange Traded Funds), Asian demand needs to rise, which we believe will take place once lower gold prices provide the right incentive," they added.

The gold price will continue to struggle against the tide of stronger U.S. dollar.

"The $1,180 level will be critical," said Hans Goetti, Head of Investment, Asia at BIL. "If it can hold that level amid continued [U.S. dollar] strength, it would be a strong technical sign. If the $1,180 level is broken on the downside, there is no support until the $1,000-1,050 area.'

The rise of the dollar index – a gauge of the greenback's value against a basket of six major currencies – has been virtually unassailable, racking up gains for a record 12 straight weeks – its longest winning streak since its 1971 free float under President Nixon.

"The dollar has had the best run since the end of Bretton Woods in the early 70s so it can be no surprise that this has damaged gold prices," said Ross Norman, CEO of Sharps Pixley in London. "I would expect the dollar to retrace which will be gold positive."

Gold bulls say it would be premature to discount the metal's traditional safe-haven appeal against a backdrop of conflict in the Middle East and equity market volatility as the West and its Gulf allies dig in for a sustained campaign against Islamic State militants.

"Defeating ISIS will be a long and expensive undertaking," said Scott Carter, the chief executive officer of Los Angeles-based Lear Capital. "A new war, against a new enemy, with new tactics, and dangerously high stakes will rattle nerves on and off the big board. In the months and years ahead gold will be called upon to provide diversification and wealth preservation as it has been throughout the history of all human conflict."