The Bank of England will announce its latest policy decision on Thursday, as experts debate how stagnant wage growth could impact the timing of its first rate hike.

Economists and strategists forecast the central bank will not raise the benchmark interest rate until February or March next year, despite hints from Governor Mark Carney that a hike is "nearing".

It has held the main rate at a historic low of 0.5 percent since March 2009, so the prospective hike could have a big impact on financial markets—which economists like BNP Paribas's Dominic Bryant say are yet to price in a rise.

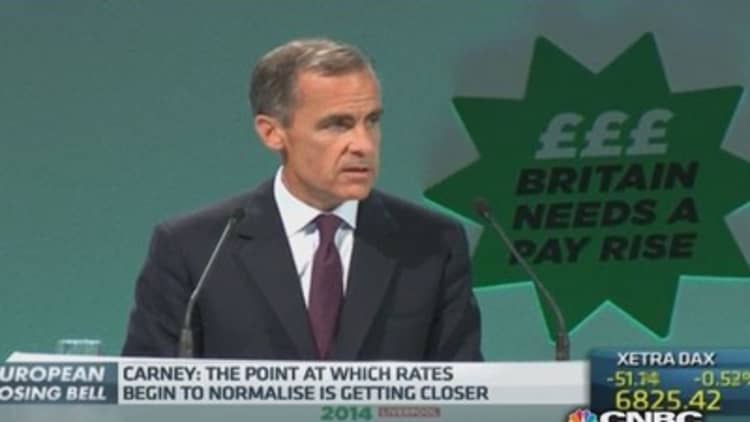

"With many of the conditions for the economy to normalize now met, the point at which interest rates also begin to normalize is getting closer," Carney announced in a speech last month. "The current inflation environment is benign. But it will not remain benign if we do not increase interest rates prudently as the expansion progresses."

Read MoreBoE's Carney: Rate hike nearing, wage growth weak

Wage levels are a sticking point, however, as they have lagged the broader recovery. In its August inflation report, the Bank of England warned that pay growth remained weak in early 2014, falling to around 1 percent in the second quarter from 0.5 percent in the first three months of the year.

The bank has insisted that a rate hike is contingent on recovery in wage growth—which it does not expect in real terms until the middle of 2015.

"Wage growth has been very weak. Adjusted for inflation, wages have fallen by around a tenth since the onset of the crisis," Carney told a conference of trade unionists in September. "To find such a fall in the past, you would have to look back to the early 1920s."

Read MoreBank of England: Bitcoin could transform stock markets

Fledgling signs of a prospective upturn in pay are emerging, however. Surveys of employee pay by the likes of the Recruitment and Employment Confederation suggest strengthening pay growth, particularly for new recruits.

In a BNP Paribas conference on Tuesday, Bryant noted that wage rises might emerge come the New Year, when employees tend to renegotiate pay.

The Bank of England may share this belief. In August it noted that wages were typically renegotiated only once a year, meaning that almost half of employees tracked by the bank are unlikely to have had a pay rise since unemployment started falling sharply in late 2013.

Meanwhile, voting patterns by the bank's policy committee suggest members may be warming to a rate hike. At the last meeting, two out of nine members—Ian McCafferty and Martin Weale—wanted to raise rates in September to 0.75 percent.

Minutes from this week's monetary policy meeting will be published later in the month, and will reveal if any more members joined the hawks in voting for a rise.