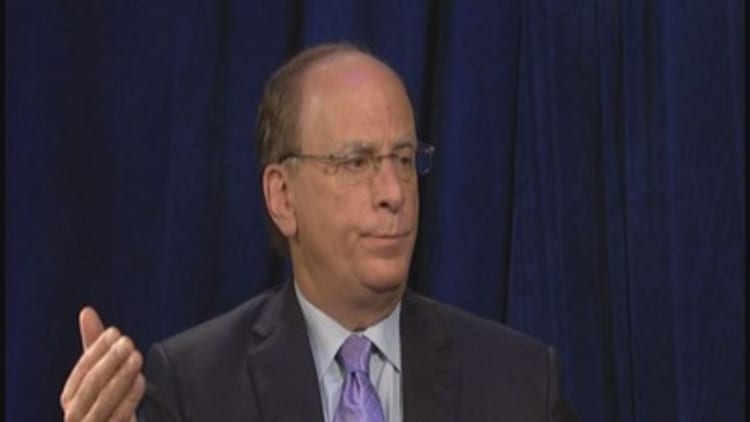

The American retirement crisis is here, said Larry Fink, the man who runs the world's largest money manager.

The CEO, chairman and co-founder of BlackRock, which had $4.3 trillion in assets under management through the end of last year—a number that surpassed the U.S. federal budget for 2014—issued a stark warning to the wave of retirees expected to draw government benefits in the coming decades. Fink believes not enough Americans have prepared for their sunset years, and it will eventually cost them and the government.

"Too many Americans are too dependent on Social Security," Fink told CNBC, contending the federal program was designed to be a backdrop to other private savings.

"To build a proper savings for retirement requires saving continuously through life," said Fink. A later start to savings, combined with Americans' increased life expectancy leaves many ill-equipped to live twenty to thirty years of retirement "in dignity."

According the U.S. Census Bureau, 35 percent of Americans over age 65 rely entirely on Social Security's monthly benefit, and 36 percent of the general population don't save anything at all for retirement. That number rises to over 50 percent for workers under age 30.

Read More Lackluster savings tarnishing seniors' golden years

Perhaps an even scarier number is the 80 percent of people aged 30-54 believe they will not have enough money put away from retirement, according Census Bureau data. Fink attributes this bleak condition in part to private companies' failure to inform employees about the importance of saving for retirement.

"We have to be noisier in the private sector," says Fink, whose firm employs more than 11,000 workers. "The business community is at risk for not educating their employees."

He took issue with the defined contribution model of retirement savings, which places the responsibility for accruing savings on employees.

Read More Which 10 states are the least prepared for retirement?

"Each individual tend(s) to live their life more for today than in the future," Fink said. "Saving for a thirty to forty year outcome is not a front and center priority," he said, when the cost of housing and private education is on the rise.

However, Fink argued it's a problem that cannot be ignored. He believes a long-term investment and savings strategy is the surest way to avoid the fear of not having enough and build a proper nest egg.

"One of the fundamental problems with individuals is they watch the news—whether it's Ebola, whether it's the volatility in the world, whether it's ISIS—they become frightened, and they pull back their investments to, maybe, more in cash," Fink said.

That conservatism, combined with large swaths of the public that don't invest in the first place, may mean missing out on long-term earnings for a nest egg.

"If you believe that the U.S. is the best place to invest over 40 years," Fink said. "You're probably going to be able to assume 6 to 8 percent compounding rate over a long time, owning equities."