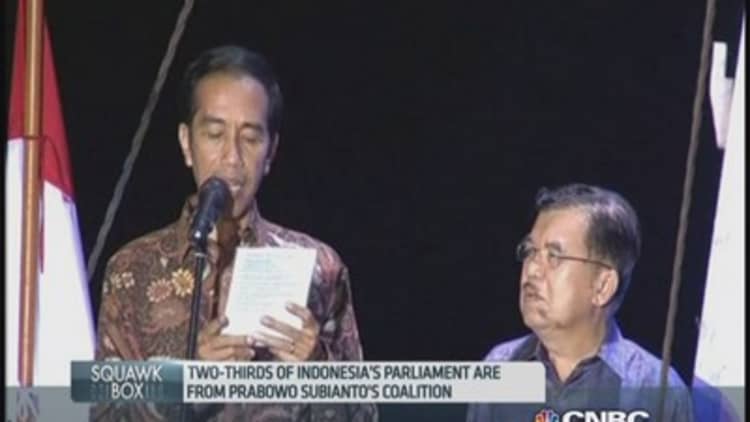

Indonesia inaugurated its new president on Monday, and analysts told CNBC Joko 'Jokowi' Widodo will have to act fast to turnaround conditions in the struggling economy.

The reforms-focused leader has a tough job ahead of him, as the country faces one of the worst income inequality gaps on record, growing concerns about corruption and a burgeoning current account deficit.

"They really need to get their act together at this point," said Medha Samant, investment director, Fidelity Worldwide Investment, adding that Jokowi needs to act fast on two objectives.

Read MoreReform-minded outsider Widodo takes over as Indonesia'spresident

"Firstly, we need to see the formation of a strong cabinet – a good mixture of technocrats and professionals that would strengthen Jokowi's election manifesto," she said.

Secondly, Samant noted the pressing need for Jokowi to cut the fuel subsidy by around 45 percent, a move widely speculated could come within the first two weeks of his term.

Indonesia enjoys among the cheapest fuel in Southeast Asia, thanks to subsidies which cost the government around a fifth of its state budget. A cut in the subsidies could save Indonesia $13 billion next year, according to Reuters, which Jokowi hopes to redirect to other parts of the economy in desperate need for funds, like infrastructure, health care and education.

Furthermore, the hefty cost of the fuel subsidies has weighed heavily on the country's current account deficit, which expanded to a larger-than-expected 4.27 percent of gross domestic product in the second quarter, up from 2.06 percent in the first quarter.

Things could come to a head as the Federal Reserve prepares to hike interest rates in the coming quarters, potentially strengthening the greenback against the rupiah which could raise Indonesia's imports costs, further widening the nation's current account deficit.

"Indonesia has a six to nine month window of opportunity before the Fed starts hiking short term interest rates," said Fauzi Ichsan, Indonesia managing director of Standard Chartered. "[He needs] to shrink its current account deficit so that by the time the Fed starts hiking, the financing requirement for Indonesia will be less."

Read MoreFuel inflation a risky juggle for this Asia heavyweight

"Jokowi will have to hike fuel prices in the next one to two months and implement his infrastructure program by early 2015," he added.

Boost for Indonesia stocks?

Since Jokowi's election win on July 9, returns on the Jakarta Composite – Indonesia's main stock exchange – have been lackluster, declining around 1.3 percent.

"Jokowi has a bifurcated cabinet, a weak majority, that's why this market has been out of favor and has been lagging behind," said Fidelity's Samant. "In the short term we could be set for a bumpy ride [in terms of Indonesian stocks] because there's a hard task ahead, given the reforms needed on the energy side as well as the infrastructure side."

Regardless, Samant believes Indonesia's long term fundamentals still look attractive: "You still have good demographics, strong balance sheets, low leverage and that's what we are focused on."