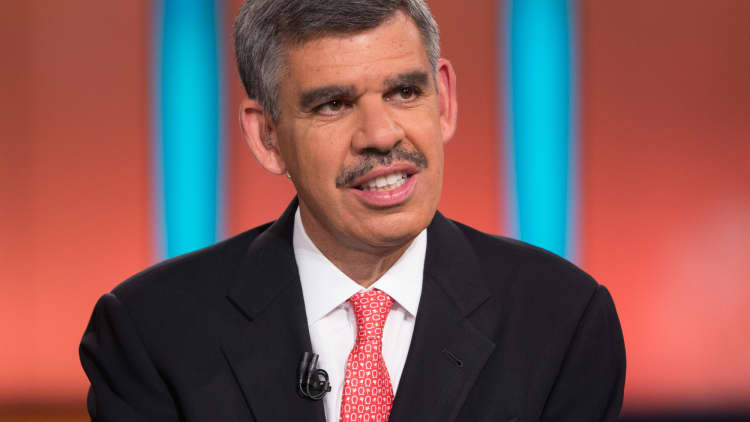

Mohamed El-Erian, the former Pimco chief executive, is moving into the peer-to-peer industry after agreeing to take an equity stake in a new lender, his first corporate venture since departing the world's biggest bond manager earlier this year.

Read MoreGross gone, but El-Erian just says no to Pimco

Mr El-Erian is the lead investor in a $12m equity raising for Payoff, as well as the anchor investor in the new venture's lending vehicle.

The sector is dominated by Lending Club and Prosper, but Mr El-Erian's investment in the new peer-to-peer group – known as Payoff – could provide a fillip for the fast-growing "P2P" industry.

More from the Financial Times:

Total names Pouyanné as chief executive

Israeli MP calls for new Palestine models

Loeburges Amgen to explore a break-up

P2P lenders, also known as direct or marketplace lenders, say they can use new technology to make online loans more efficiently than traditional banks that are saddled with new regulation and outdated IT systems.

Mr El-Erian joins other high-profile names who have entered the sector, including John Mack, the former Morgan Stanley chief executive, and Lawrence Summers, the former US Treasury secretary, both of whom sit on Lending Club's board.

Scott Saunders, Payoff's founder and chief executive, said it was seeking to help borrowers refinance their debt at lower rates than big banks and credit card companies.

In a twist to the business models of Lending Club and Prosper, Payoff plans to use behavioural science to augment its business as well as technology that incorporates new troves of online data into its loan underwriting process.

Read MoreWould have done'things differently': El-Erian

Payoff has hired Galen Buckwalter, the scientist who helped develop the matching engine of online dating website eHarmony, to fuse psychometric testing into its platform. Joe Saunders, the former Visa CEO, is Payoff's chairman.

"Scott has assembled an incredible team devoted to understanding better why people get themselves into debilitating debt and thus how to help them regain financial viability more quickly," Mr El-Erian said in an interview.

"That includes those over exposed to credit cards at rates of over 20 per cent. It doesn't take a financial engineer to tell you that their debt dynamics are stressful, undermining their ability to live fulfilling lives."

The company is located in Costa Mesa – not far from the Newport Beach, California headquarters of Pimco.

Mr El-Erian left the bond manager in January following reports of friction with Pimco's founder Bill Gross, who left the firm last month. He later told Reuters that he wanted to spend more time with his daughter.

He met Mr Saunders, a former investor in financial technology company Walz, through his daughter's drama class two years ago but did not become involved in Payoff until after quitting Pimco.

Unlike many P2P lenders that began operations primarily by connecting individual retail lenders with borrowers, all of Payoff's lending capability will come from accredited investors.

Read MorePimcoexecutives: 'The firm is moving forward'

The partnership of P2P lenders with professional investors has been criticised by some who see the industry quickly moving away from its roots.

Most of Lending Club and Prosper's loans are now funded by large institutional investors such as hedge funds or wealth management offices, as opposed to individual retail investors.

Others worry that the industry also forms part of the "shadow banking" system of non-bank financial intermediaries that could pose a risk unless its growth is matched by increased regulatory oversight.

At $7bn the amount of loans originated by Prosper and Lending Club is still a fraction of the outstanding consumer bank loan universe but both companies are growing at a brisk clip.

Lending Club is poised to sell shares to the public for the first time later this year, according to people familiar with the planned listing.