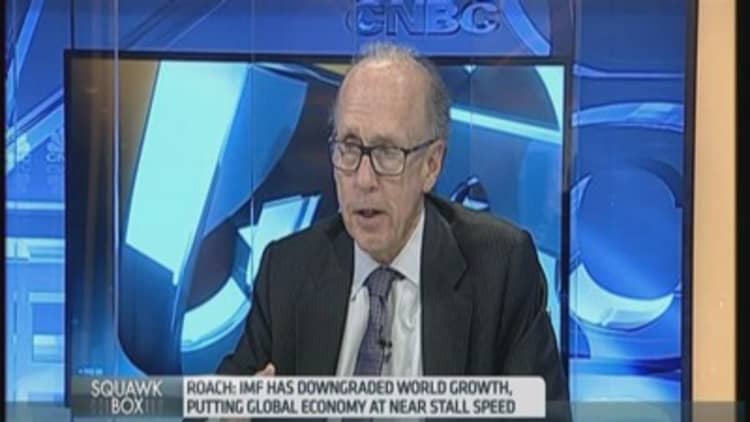

If global policy makers – particularly those in the U.S. – are to fully "open the spigots" in terms of fiscal spending and by extending accommodative monetary policy it could create bubbles in some asset markets, Stephen Roach, Yale professor and former chairman of Morgan Stanley Asia, told CNBC on Friday.

Some political leaders and economists, such as American economist Paul Krugman, have called on U.S. and European governments to implement hefty fiscal spending to stimulate growth and counter the tough austerity measures rolled out in recent years, but Roach warned that continuing down that path could be dangerous.

"The risk is if they make a policy mistake…then maybe it doesn't show up in consumer price index (CPI) inflation but maybe it shows up in asset inflation. We could have more bubbles in junk bond yields or in some more exotic fixed income instruments that could be inherently destabilizing to market dependent asset economies," said Roach.

Read MoreEurope needs to get its act together: Soros

"The wise and judicious policy maker needs to figure out that just because inflation is low does that give them free reign to open the spigots?" he added.

Roach noted that consumer price indices (CPI), a measure of inflation widely used by government which monitors the price changes of a basket of consumer goods and services bought by a typical household, may not be the best gauge of price pressures.

"We need to be much broader and more holistic in assessing the types of inflation we are benchmarking our policies to. And to look at the narrow CPI and draw the conclusion that just because it's low we can do whatever we want I think is risky," he added.

The ex-Morgan Stanley chairman also criticized Krugman's assertion that austerity can impede an economic recovery.

Krugman argues that policy makers need to realize that their reliance on deficit reduction is a "delusional" misreading of basic economics. He fiercely criticizes austerians and says governments would have been better off continuing to spend. He's not concerned about a splurge of borrowing leading to financial bubbles as leverage is decreasing.

Many euro zone economies have implemented tough austerity measure in recent years, after debt levels spiraled out of control in some of the weaker peripheral economies like Greece, Spain, Portugal and Ireland.

Read MoreIrish voters take to the streets in anti-austerity protests

Meanwhile in the U.S., after panic arose about the world's largest economy falling of a 'fiscal cliff' 18 months ago, the government has carried out a series of across the board budget cuts.

Read MoreHealth of global economy is worrying: Stiglitz

"He [Krugman] is making a big analytical conclusion saying as long as bond yields stay low then fiscal authorities should open up the spigots and spend widely," said Roach.

"I've known Paul Krugman for a long time… he's made a lot of bad calls on the markets and here he is making an analytical call on macro policy based on his ability to get the bond market call right in the future. Just because bond yields have been low doesn't mean they will stay low," he added.