The S&P health-care sector is on a tear, running a neck-and-neck race with utilities as the top-performing sector year-to-date.

As the third biggest sector in the S&P, health care's gains, powered by pharma and insurers, have helped drive the broader market, outperforming tech and financials. And the gains aren't just in stock performance; analysts project faster earnings growth in the sector than the overall market as well.

Here are four key ways to play the health-care sector, based on current stock market trends.

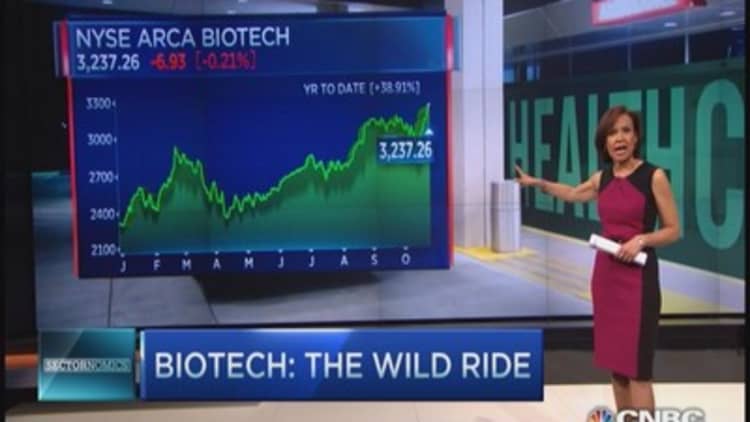

1. Biotech's wild ride—worth it in 2014.

In July, Fed chair Janet Yellen called the valuations of biotech stocks "stretched." Since then, however, these stocks have risen more than 20 percent. They're on track to exceed their five-year compounded annual growth rate of 31 percent, comparing favorably with a rate of 12.7 percent for the S&P 500.

"The sector's revenues are expected to grow 38 percent this quarter," said CNBC correspondent Bertha Coombs. "That's almost four times more than the health-care sector as a whole and 10times faster than the overall S&P. And it's driven by a number of new drug launches for some big names."

Read MoreInvestors see fat profits in obesity stocks

Vertex has risen nearly 50 percent since January. "It's not expected to be profitable until next year, when sales of its cystic fibrosis drugs are expected to nearly double and total revenues are expected to nearly triple, from $550 million to $1.4 billion," Coombs said.

Regeneron is being heavily bet on as well—it has a price-to-earnings ratio of 109 and is trading 4 percent over the mean analyst price target. After two consecutive years of earnings declines, the antibody maker is expected to earn more than $10 per share this year, according to Wall Street estimates, up from its $3.80 in 2013.

2014 health care ETF performance leaders

- First Trust NYSE Arca Biotechnology ETF: 34.2 percent

- PowerShares Dynamic Biotech and Genome: 28.7 percent

- SPDR S&P Biotech: 24.6 percent

- iShares Nasdaq Biotechnology: 22.8 percent

- Market Vectors Biotech: 21.2 percent

(Performance is year-to-date through Oct. 23, Source ETF.com)

Gilead Sciences has soared on the strength of its blockbuster Hepatitis C drug Sovaldi, potentially moving even further with the introduction of its new Harvoni treatment, which combines Sovaldi with the drug ledipasvir.

"Sales of the Hepatitis C drugs combined could top $12 billion per quarter in 2015," Coombs noted. Gillead is trading at about 5 percent below the median Wall Street price target, though the target may be raised after the drugmaker reports earnings on Tuesday—its shares have rallied near-10 percent over the past five trading sessions.

2. Forget wearables—these medical devices have current potential.

Medical device makers were seen as the big losers under the tax burden of Obamacare, but in the first full year of the law's implementation, they've really bounced back. Part of the rebound has come from acquisitions—Covidien and the . But analysts say new FDA cardiac product approvals could also be a good catalyst for players like Medtronic and Abbott Laboratories.

3. Don't deny health insurance stocks.

Investors will be watching insurers this week with heavyweights like Aetna, Wellpoint and Cigna all reporting earnings. Health-care insurers have been on a hot streak this year, and many analysts expect their bull run to continue. Take UnitedHealth, which is up 22 percent so far this year, making it the third best Dow performer. Piper Jaffray's Sean Wieland said the stock is poised to go up another 33 percent.

4. Underexamined health care is worth examining.

Traders might want to consider putting some of the laggards in the health-care sector this year on their shopping lists. Pfizer, for example, is the biggest loser in the sector, down around percent year-to-date—that's against a gain of 12 percent in its peer Merck, even though Merck fell close to 3 percent after reporting on Monday. But analysts polled in FactSet expect Pfizer's stock price to go up by around 17 percent on average.

Analysts' price targets also imply big upside potential for Agilent Technologies and St. Jude Medical.

Among the best performers you may have never hear of: it's a drug and equipment distributor that analysts are still bullish on: McKesson, up 25 percent this year and set to report earnings on Tuesday.