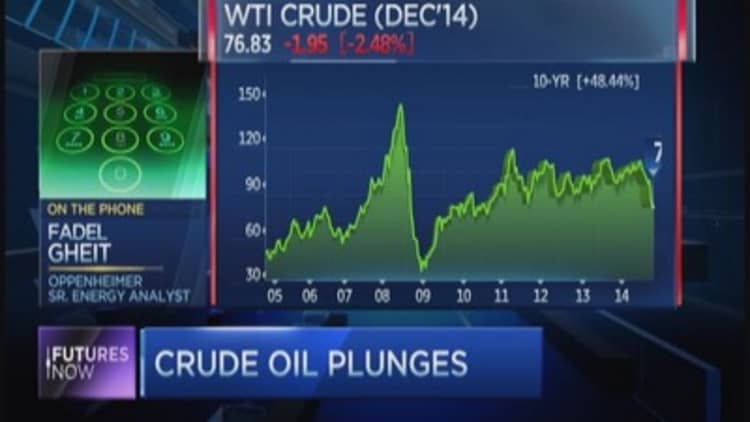

Again chatter on the Street had everything to do with how low oil prices may go, after the spot price fell 2.9 percent to $76.46 per barrel, dropping to its lowest level in over three years.

The decline accelerated afterto the United States, with some investors wondering if the Saudis were trying to create a price war with domestic drillers, in an attempt to put them out of business.

"It's widely believed that North American drillers need oil to stay near $70, on average, in order to make money," explained author and journalist Greg Zuckerman on CNBC's "Power Lunch." "Below that level and they get nervous."

By comparison, the Saudis can generate profits with oil significantly lower.

If their objective is making drillers nervous, Alan Harry of the Spartan Commodity Fund thinks the Saudis will have to let oil fall much more.

"It would need to fall much closer to $60," he said, explaining $60 is the level at which big drillers can still operate and remain relatively profitable.

Read More Why cheap oil may not help the US as much anymore

However, in the near-term, Harry doesn't think oil goes lower; he's bullish on the spot price. "I think we're about to see oil rebound back to $79, he said, largely because, the decline has been so sharp, he thinks oil has been oversold. However, he added, in a week or two, "we could break below $70."

If and when that happens, pro investor Hugh Johnson of Hugh Johnson Advisors thinks best in breed energy stocks will be buyable.

"The oil market tends to go to emotional extremes," he said, also on "Power Lunch. "It happened when oil marched above $145, and it may be happening now. Ultimately, when this is over, I think the price of oil will settle in the mid-90s."