Betting against the rich isn't easy.

Just ask short seller Jim Chanos, who for months has touted a bet against shares of Sotheby's on the grounds that the art market is in a bubble. That trade hasn't exactly panned out: Recent art sales such as the collection of legendary collector Bunny Mellon blew away estimates and Chanos took another hit Friday after Sotheby's said its controversial CEO was stepping down. The stock is roughly flat since Chanos pitched the short on CNBC in early April. It's unclear if or when Chanos took a short position and he didn't respond to a request for comment Friday.

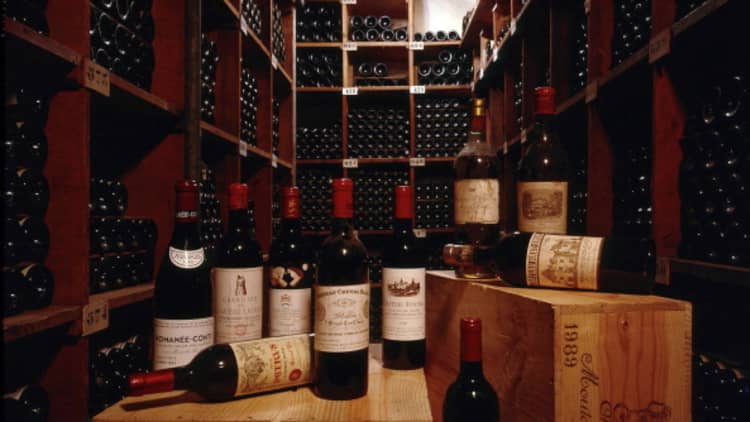

Another window into how the 1 percent spends is the fine-and-rare wine market. More than 150 wine investors and connoisseurs filled a room in New York on Thursday night for an auction held by Acker Merrall & Condit, where nearly $4 million in wine was sold. The showcase of the sale was a collection of champagne, including a case of 12 bottles of 1996 Louis Roederer Cristal Rose that sold for a record $18,525. The previous sale of that vintage was around half that price.

"Champagne was the feature of the sale, but everything was generating heat," Acker CEO John Kapon said. "Italy and California also had some big bottles."

Some 21 world records were set at the auction. Others included a case of six magnum (1.5 liter) bottles of 1985 Dom Perignon Rose for $16,055, a case of 12 magnums of 1996 Krug Clos du Mesnil for $8,028, and six magnums of 1976 Dom Perignon Oenotheque for $7,410.

Many regular bidders at Acker auctions are also major art collectors, Kapon said. Indeed, the likes of Sotheby's and Christie's host wine auctions in addition to their mainstay art events. The overlap between art and wine collectors can help auction houses tap into larger potential client pools.

Read More Art is a bubble: Here's how to short it

That said, the art and wine markets don't move in perfect parallel. The art market suffered immediately after the financial crisis in 2009 and has since been on a steady climb. Wine prices held up better in the crisis but softened in 2011 when Chinese demand for top Bordeaux pulled back.

But in some ways, the wine market looks less vulnerable to such a swing than it did a few years ago. Kapon pointed out that Thursday's auction, which included a live crowd along with online and Internet bidding, had more buyers from Latin America than from Asia. "Countries like Brazil and Mexico played a significant role," he said. "It's the first time they've been bigger than Asia at a New York auction."

One investor at the auction also pointed out that the wine market has become more efficient thanks to widely available information that's updated almost constantly. "You don't have as many insider trades anymore," he said. "It's not like there's dumb money just buying blindly."