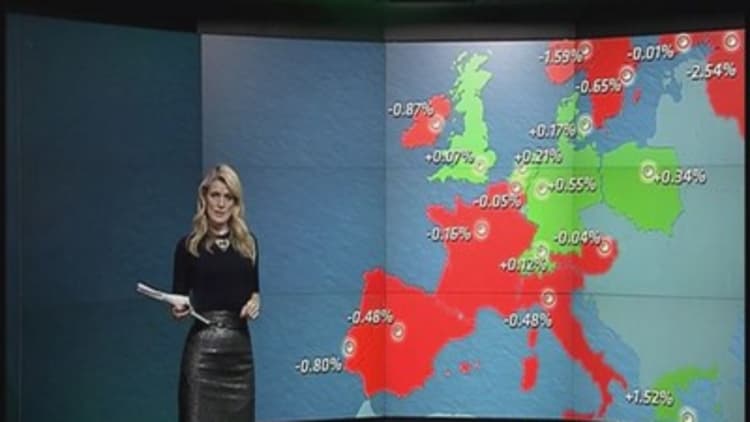

European shares closed mixed on Wednesday, with the German DAX clocking up its tenth straight session of gains.

European markets

Thomas Cook down 17%

The pan-European Stoxx Europe 600 index closed flat at 346.46. Energy stocks were showing weakness as the fall in oil prices weighed on the sector.

The DAX was the standout gainer in Europe's core, closing up around 0.55 percent, as the bourse enjoyed its longest winning streak in 18 months.

The main focus on Wednesday was travel company Thomas Cook, which announced that CEO Harriet Green will step down. Shares closed down around 17 percent following the news.

Shares in French cement maker Lafarge were also under pressure, falling around 2 percent after HSBC cut the group from overweight to underweight.

Meanwhile, Chilean copper miner Antofagasta climbed to the top of the U.K.'s FTSE 100 after Deutsche Bank reiterated its hold rating and Bernstein raised it price target and rating on the stock outperform.

Read MoreThomas Cook says CEO Harriet Green to step down

Aside from individual stocks news, sentiment got a boost from third-quarter gross domestic product (GDP) data from the U.S. on Tuesday afternoon. The figure was revised up to an annualized 3.9 percent from 3.5 percent and offset a separate report showing an unexpected drop in consumer confidence in November.

On Wednesday, meanwhile, U.S. stocks fluctuated, with benchmarks not far from record highs, after data had durable goods and jobless claims rising.

Read MoreStocks steady amid data, and as oil slide continues

Elsewhere, U.K. third-quarter GDP was confirmed at 0.7 percent compared to the period before. Before the session's open, a French November consumer confidence survey showed a rise to 87 from a reading of 85 in October.

ECB stimulus?

Market chatter has focused this week on the possibility of yet more stimulus from the European Central Bank (ECB) at a governing council meeting next week. Bourses have drifted higher in anticipation, helped by dovish words by ECB President Mario Draghi last Friday.

Read MoreBundesbank warns investors on asset bubbles

ECB Vice President Vitor Constancio said on Wednesday morning that the bank would have a clear picture on whether it should buy these sovereign bonds in the first quarter of next year, according to Reuters.

Read MoreECB can decide on QE in first quarter: Vice President

Meanwhile EU Commission President Jean-Claude Juncker unveiled a 315 billion euro ($375 billion) investment plan in Brussels, with the aim of allowing the European Investment Bank to raise funds from private investors and invest in job-creating projects across Europe.

Commodities remained in focus for investors on Wednesday, with Brent crude oil near $78 a barrel and the official Organization of Petroleum Exporting Countries (OPEC) meeting in Vienna on Thursday.