Gold prices slipped on Wednesday from this week's highs, as the market awaited a Swiss referendum on central bank gold reserves.

On November 30, voters in Switzerland will head to the polls to decide whether the Swiss National Bank (SNB) should refrain from selling any more gold and should boost its gold holdings to 20 percent, up from current levels of 7 percent.

The ultra-conservative Swiss People's party proposed the initiative, called "Save Our Swiss Gold", with the intention of boosting the security and independence of Switzerland in times of uncertainty.

Trade in the yellow metal has been muted since prices slumped to a four-and-a half-year low earlier this month on speculation of a "yes" vote. Prices have stabilized in recent days, settling at around $1,198 on Wednesday.

In the case of a "yes" vote, gold prices are likely to surge—but analysts said this was an unlikely outcome.

Read MoreCentral banks: The new gold bugs?

"The weakness of this proposal lies in the attempt to forbid the central bank to sell gold as it one day, presumably, reduces its balance sheet," said analysts led by head of research at Societe Generale, Patrick Legland in a research note on Monday.

"This could in fact present an inflation risk, which policymakers will fight vigorously."

Legland and colleagues forecast a relatively easy defeat of the motion, with support currently at around 30 percent, rather than the 50 percent required.

"Should the initiative go through, we expect the SNB would have to intervene substantially to protect the credibility of the floor initially, while actual implementation could take up to eight years," they added.

The motion, if passed, would also require the SNB to repatriate all Swiss gold holdings currently held outside of Switzerland.

Read MoreWhy is Putin buying gold?

"There is a risk there will be more support on the day," said global foreign exchange and commodity strategist at ETF Securities, Martin Arnold, in a phone email "If the proposal does pass, we would expect a sharp rally in gold."

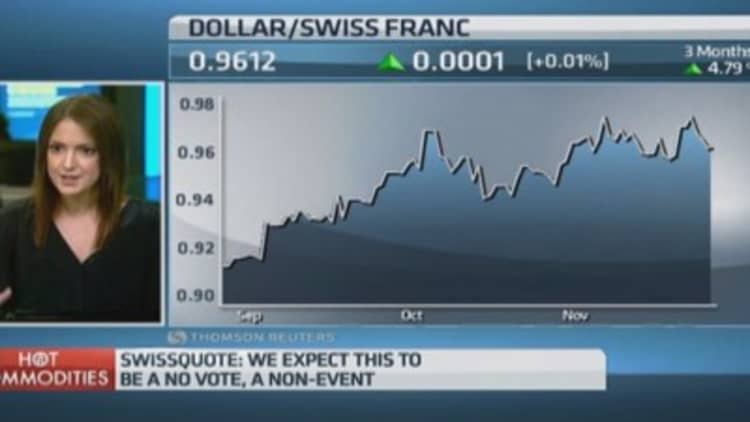

On Wednesday, the Swiss Franc remained close to 1.20-per-euro, the floor imposed by the SNB in order to prevent an overly strong currency. It maintains this by buying euros whenever the bloc's currency sinks too close to the limit.

Swiss franc volumes were heavy in the build-up to the referendum. Weekly volumes against both the euro and the U.S. stayed near five-year highs, according to Deutsche Bank currency strategist Nicholas Weng, a currency strategist at Deutsche Bank.

Read MoreTechnical move in gold ETF could be short-term bullish

"Hopes of a weaker Swiss franc are gradually fading, as market expectations for further European Central Bank easing increases. We also expect there to be a gradual realisation and acceptance of a significantly stronger Swiss franc against the euro than before the crisis," Legland said.

"Recently, SNB Vice-President Danthine suggested that fair value in fact could be around 1.28 to 1.30, which could be seen as an attempt to pre-warn markets and the public that expectations for a significantly weaker franc are not realistic," he added.