The Organization of Petroleum Exporting Countries (OPEC) decided on Thursday not to cut oil production, despite sliding oil prices.

Brent crude oil fell more than $3 to under $75 a barrel—a fresh four-year low—on the news while West Texas Intermediate (WTI)—dropped below $70. Global oil prices have plunged since peaking in June, and Brent crude has lost around a third of its price from $115 a barrel.

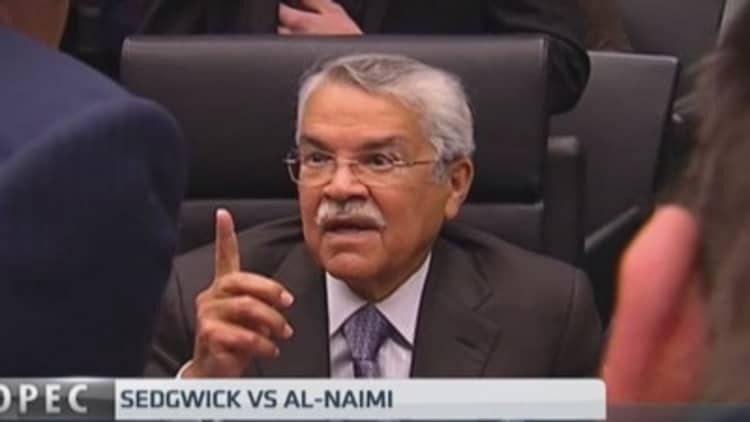

Following a meeting of OPEC in Vienna, the oil minister of leading member Saudi Arabia, Ali Al-Naimi, was asked whether the group had decided not to reduce its output from 30 million barrels per day. He responded: "That is right".

Speaking to CNBC, Nigeria's Petroleum Minister and newly elected OPEC president, Diezani Alison-Madueke, said that non-OPEC oil producers had to "share the burden" of any future cut in production.

"Of course we are hoping over the next year we will see more stability," she added.

Read MoreSaudis to push OPEC to cut output: CNBC survey

OPEC issued a statement after the highly-anticipated, five-hour meeting claiming that the ministers "in the interest of restoring market equilibrium" had decided to maintain its current production levels.

"As always, in taking this decision, member countries confirmed their readiness to respond to developments which could have an adverse impact on the maintenance of an orderly and balanced oil market," the statement said.

"The OPEC decision was certainly disappointing but not surprising," Naeem Aslam, chief market analyst at Avatrade wrote in a note shortly after the news broke. "The fact is that even if they had a cut in the production today, there are still questions in the long term over the stability of the price."

Read MoreGulf OPEC producers agree not to cut output: Rpt

Weak demand, a strong dollar and booming U.S. oil production are the three main reasons behind the fall in the price of oil, according to the International Energy Agency (IEA), which has warned of a "new chapter" for oil markets, which could even affect the social stability of some countries.

The drop in oil has weighed heavily on energy stocks but has boosted some companies that are heavily reliant on the commodity, like airlines.

Read MoreOPEC needs to 'wake up' to shale revolution

Neil Atkinson, the head of analysis at Lloyd's List Intelligence, told CNBC that oil will slide further in the coming weeks but without any "massive downside."

He added that Saudi Arabia was right to be patient in making a decision and will use the next three months to put further pressure on non-OPEC producers—like Russia—to come to an agreement on production.

One of the main pressure points on the price of oil—and on OPEC to cut its production—has been the success of the U.S. oil shale industry.

The ball to help monitor and regulate supply is now firmly in the U.S.'s court, analysts from Barclays Instant Insights said in a commodities research note. "In keeping the production target at 30 mb/d, OPEC is clearly signaling that it will no longer bear the burden of market adjustment alone and this decision puts the onus on other producers, especially US tight oil to adjust as well," the note said.

Robbie Diamond, President and CEO of Securing America's Future Energy (SAFE), a lobby group that works to improve U.S. energy security, commented on the OPEC decision in a statement.

"Whatever OPEC's decision on oil production levels, its attempt to control this commodity—the lifeblood of the global economy—exemplifies the importance of reducing oil's monopoly over U.S. transportation by pursuing policies and technologies that can free us from this cartel's influence," he said.

In the nearer term, oil could sell-off, said Petroleum Policy Intelligency CEO Bill Farren-Price.

"This is a very strong supply situation that they (OPEC) are not prepared to respond to at present," he told CNBC on Thursday.

"You are going to see excessive stock builds and a lot of oil on the water and this is going to lead to a serious market reaction."