Gold slipped on Tuesday as a strong dollar and signals the U.S. economy is benefiting from a decline in oil prices renewed expectations of a tightening in monetary policy by the U.S. Federal Reserve around the middle of next year.

Spot gold dipped 0.95 percent to $1,198.77 an ounce by 2:52 p.m. EST (1952 GMT), having gained nearly 4 percent on Monday in its biggest one-day jump since September 2013. U.S. gold futures fell 1.5 percent to settle at $1,199.40 an ounce.

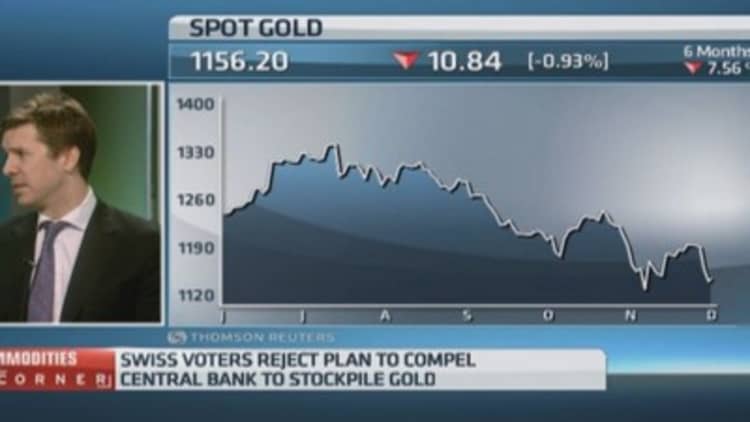

Gold prices consolidated after the spot market fell on Monday to a near-three-week low after Switzerland voted against boosting its gold reserves, then rallied to $1,220.99, its highest in a month, as oil prices recovered.

Read MoreGold shorts send metal to key $1,200

"Technically, it is important that gold holds the $1,190 area, as a breach through that level could generate further losses to that $1,140 to $1,150 range that we have seen on Monday," ActivTrades senior analyst Carlo Alberto de Casa said.

Bullion has fallen in tandem with oil in recent sessions on expectations that weaker crude prices could reduce inflationary pressures. The metal is usually seen as a hedge against oil-led inflation.

Read MoreWho are the biggest losers from gold's plunge? Not who you think

The dollar was up 0.8 percent against a basket of leading currencies at the highest since 2010, underpinned by comments from Fed Vice Chairman Stanley Fischer and New York Fed President William Dudley at separate events on Monday.

"If the economy continues to strengthen, you'll see the chances for that rate hike sooner rather than later and higher interest rates are always bad for gold because gold is a non-interest bearing vehicle," Phillip Streible, senior commodities broker for RJO Futures.

BofA Merrill Lynch analyst Michael Widmer noted trading is extremely choppy.

"Concerns over the impact of lower prices on inflation and what lower inflation does to a central bank's policy are driving factors," Widmer said.

Physical demand from Asian buyers supports gold, but prices in top consumer China were trading at a premium of less than $1 an ounce on Tuesday.