CEOs from major U.S. companies do not expect strong economic growth in 2015.

The Business Roundtable's fourth-quarter CEO Economic Outlook Index, a composite index of CEO expectations, fell slightly from the third quarter with declines concentrated in capital spending. The index declined to 85.1 for the fourth quarter, compared with 86.4 in the third quarter. A reading of 50 or above indicates economic expansion and below 50, an economic contraction. The long-term forecast is at 80.3.

Gross domestic product in 2015 is expected to grow 2.4 percent, consistent with the CEOs' 2014 forecast.

Read More Fed leak revealed potentially market-moving info: Report

The Business Roundtable is an association of U.S. CEOs that represent companies with $7.4 trillion in annual revenues. Every quarter, they release the CEO Economic Outlook Survey that forecasts the health of the economy by asking CEOs to report their companies' plans for the next six months in sales, capital expenditure and employment. The fourth-quarter survey included responses from 129 CEOs, 63 percent of the roundtable membership.

The CEOs cited tax policy and regulatory issues as the two key factors that deter the pace of U.S. investment spending. Regulatory costs were identified as the top cost pressure that CEOs face in their companies, followed by labor costs.

Read MoreHertz names Icahn-backed candidate as CEO

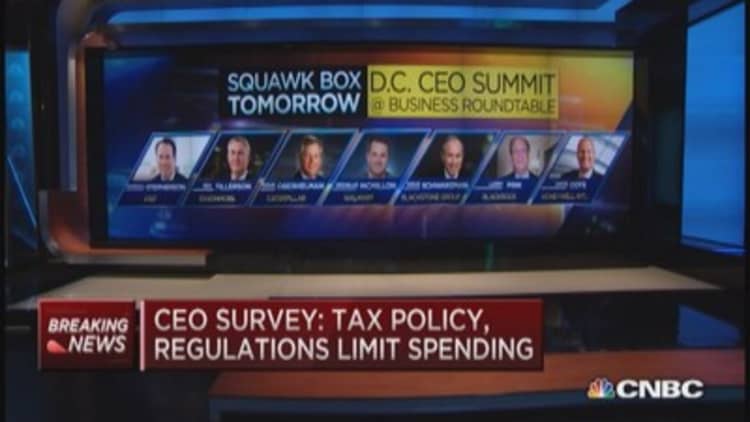

"The economy ended the year essentially where it started, performing below its potential," said Randall Stephenson, chairman of the Business Roundtable and CEO of AT&T.

"Congress and the administration should act now on tax extenders and trade promotion authority to encourage additional business investment in the United States to help the economy grow and create more jobs."

Several Business Roundtable CEOs will appear on CNBC's "Squawk Box" on Wednesday morning, including ExxonMobil's Rex Tillerson and BlackRock's Larry Fink.