Oil prices fell to a five-year low on Monday, after Morgan Stanley cut its 2015 forecast for Brent crude, citing oversupply.

The bank said Brent crude prices could average as little as $53 per barrel in 2015, although its base case scenario was for $70. This was down from an earlier estimate of $98.

"Without OPEC intervention, markets risk becoming unbalanced, with peak oversupply likely in the second quarter of 2015. Prices are set up to fall in the first half of 2015," said analysts Adam Longson and Elizabeth Volynsky in a report out late on Friday.

The price of oil has declined by around 40 percent since June, with Brent futures falling bellow $67 on Monday—their lowest level since October 2009.

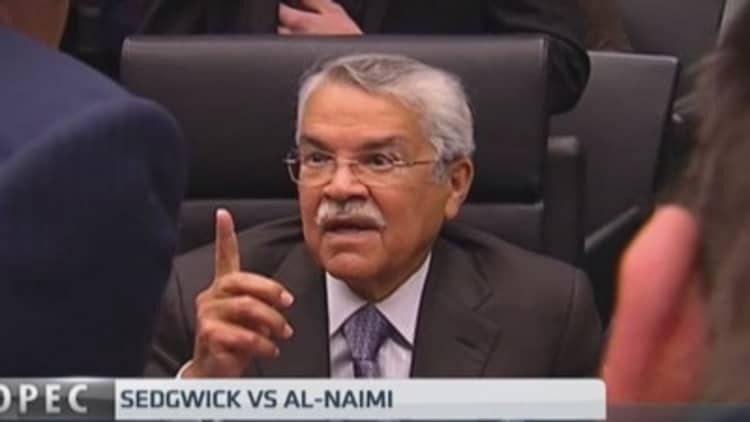

The Organization of the Petroleum Exporting Countries (OPEC) fueled the decline further last month, when it resisted calls to reduce production in order to boost prices.

Now, Morgan Stanley has cut its Brent forecast for all of 2015, 2016, 2017 and 2018. In the worst case scenario, the bank said oil could fall as low as $43 in the second quarter of next year, recovering to only $48 in the third quarter.

"With OPEC on the sidelines, oil prices face their greatest threat since 2009," said Longson and Volynsky. "Without intervention, physical markets and prices will face serious pressure, with the second quarter of 2015 likely marking the peak period of dislocation."

Read MoreOil battle is sticky, but OPEC may be forced to act

Light crude oil prices also fell by over a dollar on Morgan Stanley's report, to $64.77 from $65.84.

Longer-term, the decline in prices could prove to be self-limiting however.

"Lower prices will curtail investment, increase the risk of OPEC intervention or an outage, or even shut in wells. Based on our forecasts, activity should slow sharply, and if intervention is large and swift, price recovery in 2H15 (second half of 2015) could be swift as well," the analysts said.

Saudi Arabia—the top producer in OPEC—sees oil prices stabilizing at $60, Dow Jones reported last week.