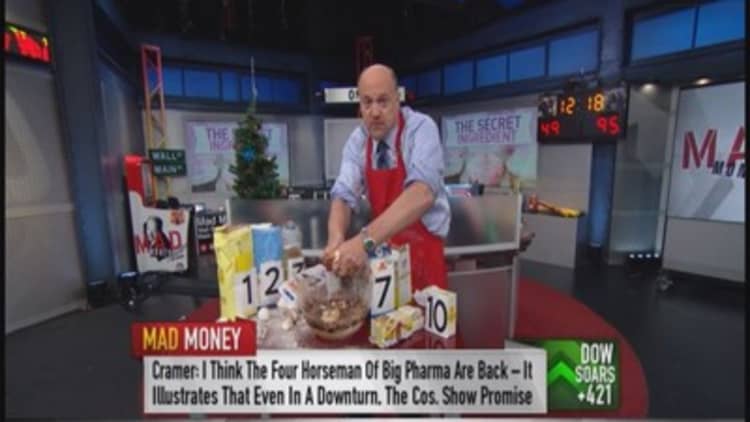

Jim Cramer has been in the stock market long enough to recognize the good signals for a rally when he sees one. What are those ingredients? Just look around, they're all in the stock market right now!

The most important ingredient is growth without inflation. Federal Reserve Chair Janet Yellen confirmed at the most recent Fed meeting that the U.S. has that exact combination currently.

"That's always been the holy grail of every single rally I have ever seen since I started investing in 1979," the "Mad Money" host said.

The next ingredient is a reduction in Fed resistance. Fighting the Fed is not a good idea for stocks. In order to avoid competing with the stock market, the Fed likes to keep rates low. Investors can make a ton of money owning stocks this way. Cramer sees that the Fed is on the side of the bulls these days. Though Yellen is sitting on a $4 trillion balance sheet of bonds, she will not sell them. Cramer thinks investors shouldn't moralize. Just know this is a positive condition for stocks.

Third is to keep the government off the front page of the business section of the paper. Right now the only thing President Obama is on the front page for is for opening U.S. and Cuba relations. Politicians are toxic for higher stock prices.

Fourth is a reduction of geopolitical worries. Putin extended the olive branch a bit when his commentary in a recent press conference indicated he was willing to talk peace. He is the biggest menace in the world right now, so if he's out of the news then that can let Europe breathe a sigh of relief.

Next is a commodity or currency that goes up or down with great velocity. Right now it's oil.

"Sure, oil's breaking down again and I don't expect it to be able to stay in the fifties. There is too much supply and not enough demand and OPEC has lost control of pricing because of our still growing output."

The sixth ingredient is takeovers and potential takeovers. Pantry, a small convenience store chain, received a bid from Couche-Tard on Thursday. Additionally, Tony Vernon the CEO of Kraft is suddenly retiring. Does this mean Kraft is up for sale?

"Why not? It could fetch big numbers and is a natural for Nestle to merge with," Cramer said.

Profits are the next essential for a rally. They seem very strong right now, partially because oil is so low but also because businesses are doing better. Darden and Jabil just announced fabulous numbers, as did Oracle. Cramer finds the fact that cloud based companies like Oracle and Salesforce.com, are roaring pretty darn interesting.

Next up is big cap buybacks. When big cap companies are doing huge buybacks, like Boeing and 3M, investors love the high dividends and the market will be eating out of the palm of the company's hand.

Ninth is the biotech bounce. Cramer's four horsemen of the big pharma apocalypse are on fire right now. That is Celgene, Biogen, Regeneron and Gilead.

----------------------------------------------------------

Read more from Mad Money with Jim Cramer

Cramer Remix: Here's what the Fed did

Cramer: Breaking the link between oil and stocks

Cramer: Time to tame the oil beast

----------------------------------------------------------

"This is a very big deal because people are recognizing that even in downturns these companies' prospects are terrific," he said.

The last perfect ingredient, are quiet foreign markets. Europe is up, China has been okay lately. Emerging markets are quiet. Let's breathe.

So it looks like for the moment, the perfect recipe is working. The market has become seasonably strong, and Cramer is seeing the perfect recipe for a Santa Claus rally. Ho ho ho!

Questions for Cramer?

Call Cramer: 1-800-743-CNBC

Want to take a deep dive into Cramer's world? Hit him up!

Mad Money Twitter - Jim Cramer Twitter - Facebook - Instagram - Vine

Questions, comments, suggestions for the "Mad Money" website? madcap@cnbc.com