European shares ended higher on Monday, with sentiment boosted by a rebound in the Russian ruble . However, earlier gains in the oil price reversed, pressuring energy stocks.

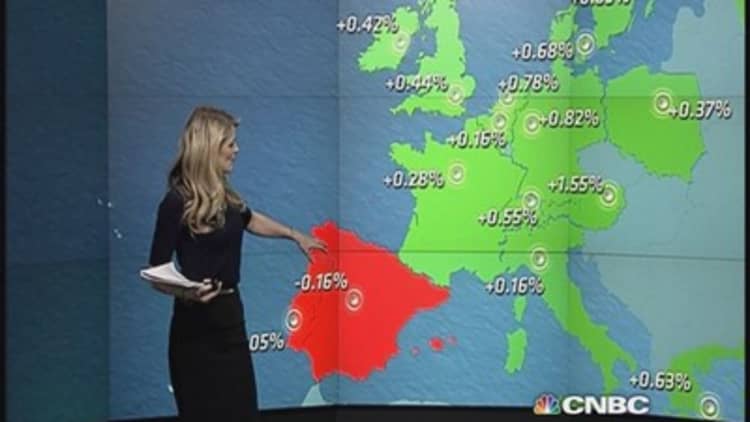

The pan-European FTSEurofirst 300 closed 0.4 percent higher at 1,366. The German DAX saw gains of 0.8 percent, London's FTSE closed up around 0.4 percent and the French CAC unofficially ended 0.3 percent higher.

European markets

Sentiment was positive on Monday, following volatility in recent weeks due to the heavy drop in the price of oil and Russia's economic and geopolitical woes.

Read More'I'd rather own Russia than Apple': Pro

However, the Russian ruble firmed to a 10-day high against the dollar on Monday, as exporters sold foreign currency revenues.The ruble gained as much as 5.5 percent against the dollar at 55.33 and over 6 percent against the euro.

Oil prices rose in early trading on Monday, but later fell below $61 a barrel after Saudi Arabia indicated it could increase its output. Brent fell to around $60.29 and U.S. WTI front-month contracts fell back to $55.82.

Read More

U.S. stocks rose on Monday, with the extending gains after its best weekly performance in nearly two months. Equities briefly cut gains after a report had existing home sales down 6.1 percent to 4.93 million in November.

Trading volumes both in Europe and the U.S. is likely to fall off ahead of the Christmas holiday on Thursday.

Euro zone confidence

On Monday, an official flash estimate showed euro zone consumer confidence edge 0.6 points higher for December.

In stocks news, Alstom shares closed more than 5 percent lower after the French energy giant pleaded guilty to bribery charges levied by the U.S.

Shares of insurer Delta Lloyd slipped more than 3 percent after the Dutch central bank fined the company over alleged improper gains in 2012.

Tullow Oil also slid over 4 percent on oil price weakness.

Follow us on Twitter: @CNBCWorld