U.S. oil futures ended higher on Tuesday in choppy trade after earlier rebounding from a 5-½-year lows, as persistent worries about a global supply glut offset concerns about output disruptions in Libya.

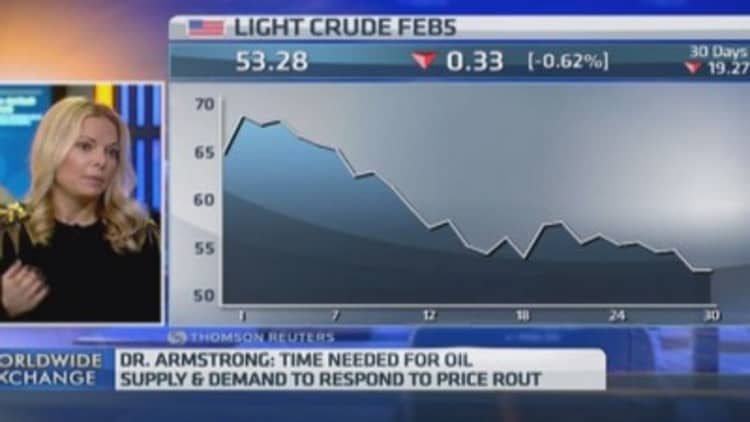

Benchmark Brent crude was on track for its second weakest month since the global financial crisis of 2008, and traders said the sell-off that has halved crude prices in six months showed no sign of coming to an end.

U.S. crude closed 51 cents higher at $54.12 per barrel, after hitting a 5-½-year low on Tuesday morning, falling to $52.70.

Brent crude was up about 12 cents at $58 per barrel. It also hit a 5-½-year in early morning trade, dropping $1.14 a barrel to $56.74, its lowest since May 2009.

Read MoreUS agency gives quiet nod to light oil exports: Sources

Oil markets have been heavily oversupplied this year due to increasing output of high quality, light oil from U.S. shale and lower-than-expected consumption as a result of faltering global economic growth and competition from alternative fuels.

Several members of the Organization of the Petroleum Exporting Countries have suffered supply disruptions in recent months, but this has had little impact on prices.

In Libya, clashes between rival factions have closed oil ports and terminals this month, reducing exports from the OPEC producer, which used to sell over 1 million barrels per day of crude to world markets, to almost nothing.

OPEC, which pumps a third of the world's oil, had been expected to trim output to try to stabilize prices, but it decided in November to keep production unchanged and let the market find its own level.

Read More Saudi Arabia doesn't care about volatile oil

PVM Oil Associates analyst Tamas Varga saw no let-up in the sell-off, saying "the bears" were in firm control of the market.

"The trend is still down and supports are expected to be under pressure. It is not recommended to go against this trend," he said.

Reuters technical analyst Wang Tao said Brent may fall to $54.98 while U.S. oil is expected to drop to $52.10.

Read MoreHow to pick junk-bond jewels despite oil's slide

Investors awaited U.S. inventory data. The American Petroleum Institute was scheduled to release data on Tuesday while the U.S. Department of Energy's Energy Information Administration will issue data on Wednesday.

A Reuters poll forecast U.S. crude inventories would show a drop of 900,000 barrels, after a rise to their highest recorded level for December in the week ended on Dec. 19.

Correction: This story has been updated to reflect the correct closing price for U.S. crude oil.