Jim Cramer sees two large macro-economic themes at work that are having major impact on the U.S. economy currently. First is oil, which he has covered endlessly since it began the rapid decline. The second is the nosedive in yields for the U.S. Treasury bonds, which could prove to be a big deal for the economy.

As a review, when the price of a Treasury goes up, the interest rate goes down, and vice-versa. The foreign economic landscape has been treacherous as of late, thus money has been flooding into U.S. Treasurys as investors seek financial security.

It makes sense, right? Wealthy investors want to take their money out of weaker economies, and are pouring it into the U.S. dollar and U.S. bonds. After all, the U.S. has the strongest economy with a strong currency and investors want to secure their money.

The result of the incoming flooding of foreign money has sent Treasury prices higher, and interest rates lower.

How long can this rally really last, and how low can interest rates go?

To find out, Cramer spoke with technician Carley Garner, co-founder of DeCarley Trading, author of "A Trader's First Book on Commodities" and colleague of Cramer's at RealMoney.com.

Garner noted that the rumors from experts in 2015 assume that this year will yield lower interest rates and higher prices. That makes sense given what is happening overseas.

However, a look at the charts shows a different pattern. Historically speaking, when the economy has gotten stronger, the price of Treasury bonds go lower and the yield goes higher. That's the opposite of what is predicted for this year.

And the signs of a strong economy are here. The market is not far from record highs, the unemployment rate is at a low 5.6 percent, and the Federal Reserve is on track to raise rates later in the year. It's a perfect concoction for higher interest rates and lower bond prices.

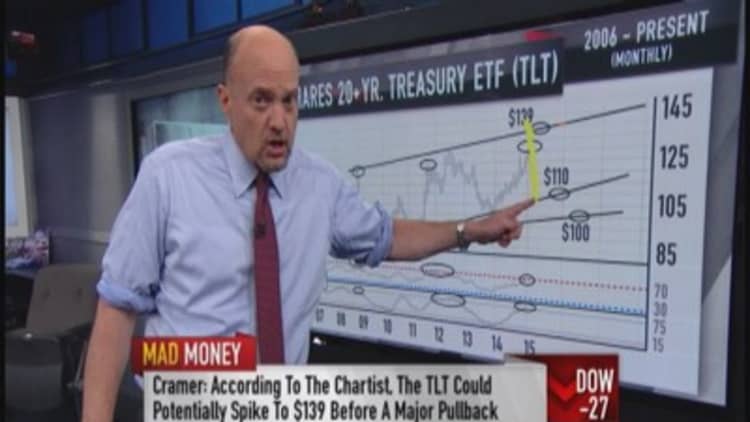

Looking at the weekly chart of the iShares 20+ year Treasury ETF, otherwise known as the TLT, Garner sees that the U.S. Treasuries are dramatically overbought currently. That means the price of bonds came up way too quickly and could likewise be headed for a dramatic decline.

And let's not forget that there is foreign currency to consider, since this all relates to currency flooding into the U.S. from foreign countries. For that Garner turned to the dollar index, which measures the strength of the U.S. dollar versus a basket of foreign currencies.

The weekly chart indicates that there is a strong correlation between the U.S. dollar and futures contracts for the 30-year Treasury note. That means U.S. currency and government backed securities will rise and fall together.

Additionally Garner saw signs that the U.S. dollar is overbought and is due for a pullback. She believes that the dollar will be headed down and that it will take the Treasury bonds down with it.

----------------------------------------------------------

Read more from Mad Money with Jim Cramer

Cramer Remix: Stay away from this stock

Cramer: How we know when oil is too low

Cramer: Time to ring the register on this hot biotech

----------------------------------------------------------

If Garner's interpretation is correct, then Cramer thinks this could be big news for 2015.

"We could soon see a major decline in the dollar and the price of U.S. Treasuries, which would translate directly into a significant rebound in interest rates. That would be a very big deal."

Questions for Cramer?

Call Cramer: 1-800-743-CNBC

Want to take a deep dive into Cramer's world? Hit him up!

Mad Money Twitter - Jim Cramer Twitter - Facebook - Instagram - Vine

Questions, comments, suggestions for the "Mad Money" website? madcap@cnbc.com