For the past several decades, the traditional 60 percent stock, 40 percent bond allocation has dominated the investment industry. But since 2000, interest rates have declined to historic lows at or near zero percent. While this has given bond returns an historic tailwind, it begs the question: Have bonds become an unproductive portfolio-allocation tool?

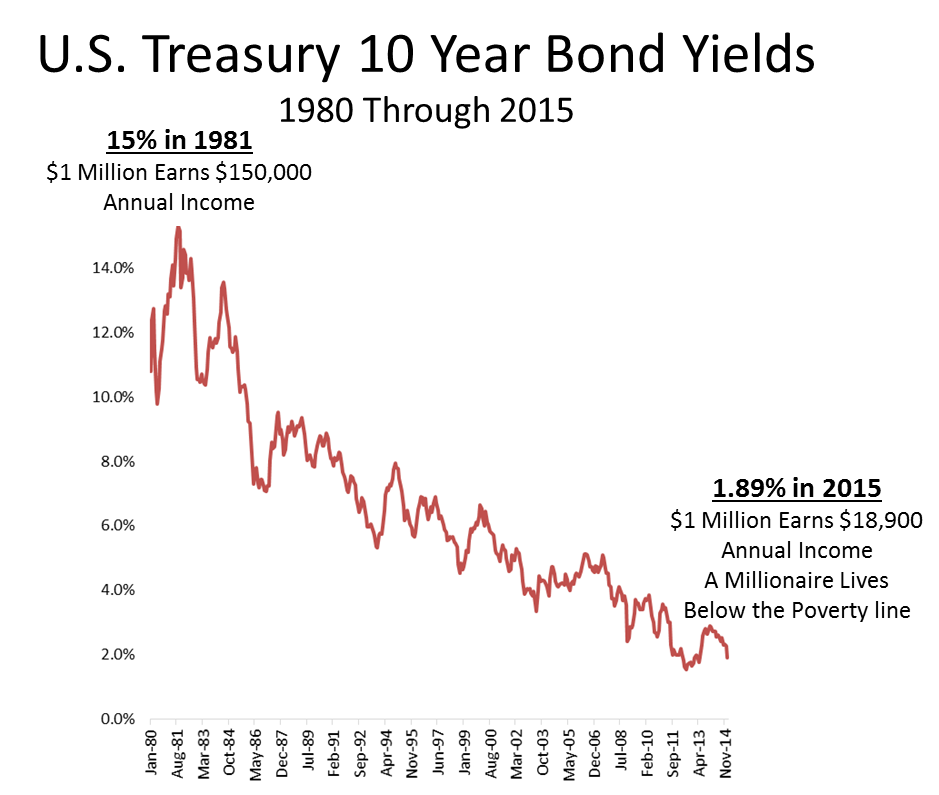

Shortly after I entered the investment industry in 1980, inflation had risen to double-digit levels. Fed Chairman Paul Volker made a decision to attack this problem by raising interest rates to record levels. From the 20-percent peak in 1982, the Fed-funds rate has declined to zero, creating the greatest bond bull market in history.

Read MoreDow down triple digits, pressured by commodities

This chart, courtesy of Robert Shiller of Yale, shows the change in 10-year U.S. Treasury yields from 15 percent in 1981 to the current 1.89 percent in 2015. To put these numbers in perspective, in 1981, an investor with $1 million could purchase conservative 10-year U.S. Treasury bonds and earn a very productive $150,000 per year. Today, that same $1 million in 10-year U.S. Treasurys earns just $18,900.

A millionaire living below the poverty line!

In many cases, short to intermediate, high-quality bond yields have fallen below the level of the fees charged by investment advisors, creating negative returns for clients.

Warren Buffett says it best: "[B]onds should come with a warning label."

Read MoreCramer: Markets have a 'mood disorder'

As I talk with advisors and investors throughout the country, it is clear that rather than look at new ways to create productive low-volatility returns, advisors are reaching more and more into risky asset classes, primarily stocks and high yield bonds, to get the returns they need to satisfy their clients. The time has come for advisors to think beyond simple asset classes to create returns: Strategies will become the new portfolio tool for creating reasonable returns while still controlling volatility

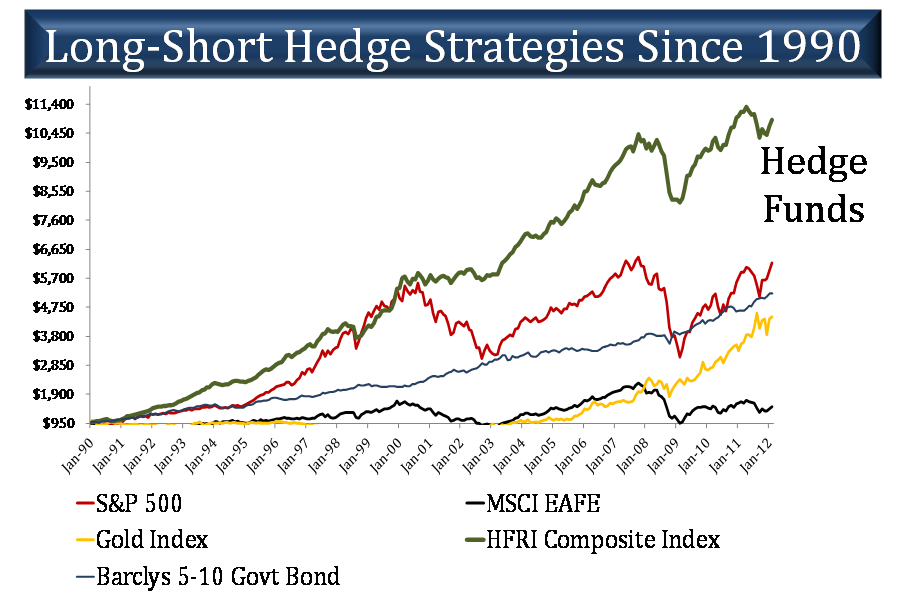

This chart compares returns since 1990 for the S&P 500, international stocks, bonds (Barclays 5-10 year Government Bonds), gold and the Hedge Fund Research-HFRI Composite Index. Since its inception in 1990, the HFRI index of hedge fund strategies has outperformed all the primary asset classes with much lower volatility and drawdowns.

With interest rates nearing zero, investors and advisors need new tools that will allow them to earn productive returns while protecting client capital. Over the past 25 years, conservative hedge-fund strategies have delivered equity-like returns, regardless of market direction, with bond-like volatility. As advisors and investors are adapting to this zero interest-rate environment, conservative long-short hedge funds offer an attractive alternative to the unproductive traditional bond allocation.

Read MoreDelayed liftoff: Markets now see October rate hike

Commentary by Michael Elfers, founder, CEO and chief investment strategist at Irvington Capital LLC.