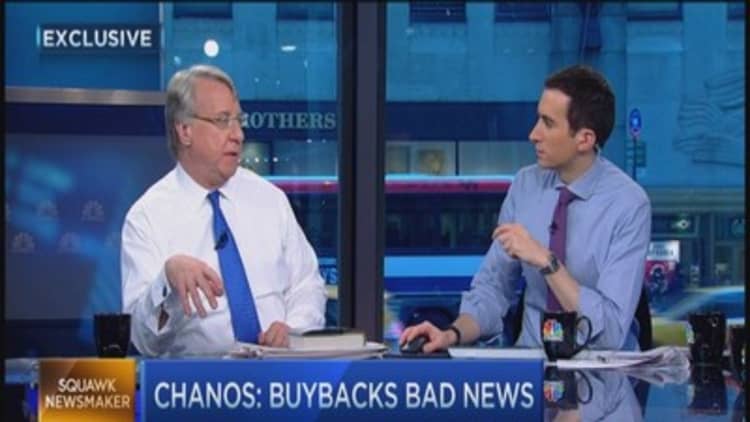

Jim Chanos, head of the world's largest short-selling hedge fund, revealed on CNBC Friday that he's been short Intel for about six months because of his concerns about the personal computer business.

Responding to the Chanos short disclosure, Intel CEO Brian Krzanich said on "Squawk Box" that he's "very comfortable from a where-our-customers-are [perspective], where our inventory is, across the supply chain."

Intel late Thursday reported quarterly earnings and revenue that topped forecasts, but first-quarter margin and revenue guidance came in slightly light.

Separately, Chanos, founder of Kynikos Associates, also made a case against electric automaker Tesla.

"The guts of this product [the battery] is made by Panasonic," he argued on "Squawk Box" Friday. "It's a manufacturing company. It's an auto company. It's not a change-the-world company."

He refused to disclose whether he's short shares of Tesla—only saying, "I am a potential purchaser of the stock," which may suggest that he is in fact short.

Chanos said the problem he has with Tesla is that it's valued on projected 2025 earnings, but the company can't forecast the next quarter.

Back to his pessimism on Intel—which makes semiconductors that power PCs—Chanos said: "We just see continued pressures on PC-makers, components-markers. You see the rise of companies in China."

He said he's also been short Hewlett-Packard for a while for the same reasons as his position on Intel. At the CNBC and Institutional Investor Delivering Alpha conference in 2012, he first talked about shorting HP

"[But] We're long Apple," Chanos said Friday, "because you're getting Apple at a lower multiple than Hewlett-Packard or some of the others and yet it's growing, it's innovating and throwing off tons of cash."

Kynikos has $3 billion in assets under management.