This week, most traders will mourn the end of the greatest dynasty: The CME Group has decided to close futures open outcry operations.

Trading in the pits could be compared to gladiators battling it out in the Colosseum, with the kings of the hedge funds and the common people watching from the stadium seating. The gladiators would enter their arena armed with a pen as their sword, cards as their shields, mesh jackets as their armor, and the battle cry of "SOLD."

Read MoreWhy the CME shutting down floor trading matters

The energy would build from the time the players entered the pits to the time the bell rang out across the globe to open the game. The outsider would look upon the chaos in the pits with wonderment, as the battle of facilitating an efficient execution ensued. When a big order hit the pits, the gladiators would surge toward the action to fight for their share and their livelihood. It was the only place that one could find a high school dropout and an MBA grad equally armed, ready for battle.

Yes, the execution is faster now that we trade electronically (I have broken golf clubs waiting for fills) but when it was open outcry, there were never "fat finger trades" that could move the markets hundreds of points in the blink of an eye. There was a circuit breaker, where if the order was "odd," brokers and traders would question it before blasting the pit. If the order was used to "paint" the settlement, it was discounted. If you hit the bid or offer, it didn't disappear.

Read MoreHere's where crude could bottom: Oil trader Hall

For the screen trader, the markets seem to be more efficient and one can find a vast number of markets to trade at any given time, but at what cost? In my opinion, the loss of the pits has contributed to the struggles of the economy, especially here in Chicago. Velocity of money has slowed. The amount of money that has since left, and the economies it supported, has greatly diminished the recovery. Now a trader or broker doesn't need several people to help facilitate and check trades. All of those people would leave the floor and go back to their respective communities (some traders lived as far away as California, New York and Florida) to spend their money in very different ways, which increased the velocity of money.

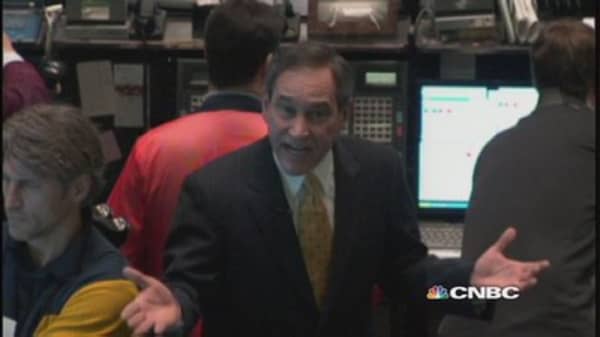

Rick Santelli's famous Tea Party rant about Obama's mortgage-bailout plan with Eric "The Wolfman" Wilkinson from the floor of the CME:

Unfortunately, the transition from the floor to the screen has not been easy for most traders and brokers. One of the biggest brokers in the bond pit is now parking cars and the biggest trader (who owned skyscrapers) has now lost everything. The "real world" does not value pit experience, which is why so many have found this transition very difficult. Some have moved on to become financial advisors, portfolio and risk managers, which I think is great for the industry. Many have become small business owners and restaurateurs. But too many are still struggling to find acceptance or their next career.

Read MoreTime to cash out this 'American Sniper' stock

I was in the pits for 20 years. I can tell you firsthand that it is a difficult transition to sitting behind a desk and trading. I long for the excitement and the camaraderie of the pit atmosphere, that staring at a screen cannot duplicate. On the other hand, it has helped me grow as a trader and investor. I can now quickly search and trade many different markets, which were not accessible on the floor, from the blue hue of my eight screens.

I still trade stocks, futures and options, although I am looking to branch out into portfolio management. I loved open outcry and I also morn that the dynasty has ended.

Commentary by Eric Wilkinson, an independent trader who worked in the CME pits for 20 years. He was known as "The Wolfman," who was behind CNBC's Rick Santelli in many a live shot, including Santelli's famous Tea Party rant about Obama's mortgage bailout plan in 2009 (Watch the clip). He still trades stocks, futures and options. Follow him on Twitter @WolfmansBlog.