But I know that the FBI and SEC have known about this for decades because I personally flagged it to them in 1989, when Crazy Eddie was busted for fraud and I was trying to avoid prison time. (Which I did.)

Read MoreSwiss prosecutor raids HSBC office, opens criminal inquiry

During my criminal career at Crazy Eddie, my family used Bank Leumi to help them evade taxes, hide assets, and launder money because of their exceptional client services and discretion. From 1971 to 1984, I was intimately involved in my family's scheme to underreport cash revenues and evade income taxes at Crazy Eddie when we were a private company. Bank Leumi sent its Israeli employees to New York to assist my family in opening secret numbered accounts in Israel, ferry their skimmed cash overseas, and later helped them launder that cash back into the United States when they needed access to those funds.

Family members handed over briefcases full of cash to Bank Leumi employees. When family members boarded their El Al flights to Israel, somehow the cash was waiting on the plane for them. The Israeli bankers personally handed over to family members all bank documents to avoid using U.S. mail. When my family needed cash, they obtained sham business loans from Bank Leumi-USA, but those loans were secretly secured by the cash deposited at Bank Leumi-Israel. They were able to deduct the interest paid on those loans as a business expense, while earning tax-free interest on the funds deposited overseas.

Read MoreMoney-laundering probe targets Putin's inner circle

Then in 1984, after we went public, we stopped doing income-tax fraud to engage in the more lucrative business of screwing investors by doing securities fraud. From 1984 to 1987, we overstated our income to reap huge financial rewards by selling stock to unsuspecting investors at inflated prices. We used Bank Leumi to launder cash back into Crazy Eddie through a foreign dummy corporation in Panama to overstate our sales and profits to drive up the stock price. The financial rewards that my family reaped by selling stock at inflated prices many more times covered the added cost of Crazy Eddie paying corporate income taxes on the laundered cash.

Even after the U.S. government cracked down on secret bank accounts in Switzerland, Bank Leumi never stopped – in fact, it went into overdrive to attract new customers, according to a statement by New York regulators after a deal was reached.

I delivered Bank Leumi to the feds on a silver platter 25 years ago, so there appears to be no plausible excuse for the delay in taking action against them.

Read MoreAntar: This guy is a former FBI agent but the worst crook ever!

A lot of Bank Leumi's customers, particularly in the New York Jewish community, are crapping in their pants waiting for the next shoe to drop, but they should have been worried 25 years ago. Anyone who used Bank Leumi's competitors in Israel to evade taxes should be crapping, too. Bank Leumi is required to help the Justice Department investigate other Israeli banks.

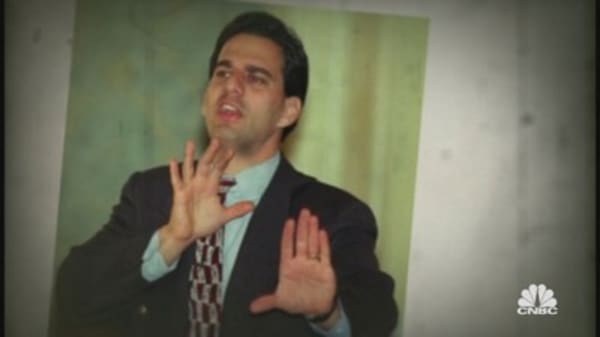

Commentary by Sam Antar, the former CFO of Crazy Eddie, former CPA and a convicted felon. He now teaches law-enforcement professionals how to catch the crooks. Follow him on Twitter @SamAntar.

Editor's Note: Bank Leumi had no comment on this op-ed but referred to its official statement following the NYDFS findings: "The Leumi Group has reached an agreement with the U.S. Department of Justice and New York State Department of Financial Services. As has been previously disclosed, we have been cooperating with the authorities and are pleased to resolve this matter." A Justice Department spokesperson said, "We follow the facts and evidence wherever it leads us and take appropriate action. I cannot speak for decisions made more than 25 years ago, but what I can say is that this Justice Department has made it a priority to hold banks and other financial institutions responsible for their criminal conduct." The FBI declined to comment and said it had nothing to add. The SEC did not respond with a comment.

Read MoreEx-Galleon trader tells all on insider trading

Does all this crime talk have you in the mood for more? Tune in to CNBC tonight at 10pm for the 100th episode of "American Greed." Tonight: The "dirtiest" con. (Watch below or click here for a sneak peek.)