The European Central Bank (ECB) will kick off its 60 billion euro-a-month ($66.3 billion) bond purchases on March 9, ECB President Mario Draghi said Thursday, after it decided to keep rates at record lows.

The central bank also upped its growth forecasts after better economic news from the euro zone, while cutting its inflation forecast for 2015.

Growth, inflation estimates revised

After a spate of encouraging economic data, including signs that business activity is accelerating, the ECB hiked its growth estimate to 1.5 percent for 2015, up from 1 percent in December last year. It expects gross domestic product (GDP) to expand by 1.9 percent in 2016 and 2.1 percent in 2017.

The ECB also revised its inflation forecast for this year to 0 percent, down from its previous 2015 inflation forecast of 0.7 percent, but raised the 2016 forecast to 1.5 percent from 1.3 percent.

It comes after the region's annual inflation rate turned negative in December 2014, falling to minus 0.2 percent.

Speaking to reporters after the ECB's monetary policy meeting, this time held in Cyprus, Draghi said: "We will, on 9 March 2015, start purchasing euro-dominated public sector securities in the secondary market. We will also continue to purchase asset-backed securities and covered bonds which we started last year."

"A cyclical recovery along the lines of March staff projections is no ground for complacency," he added.

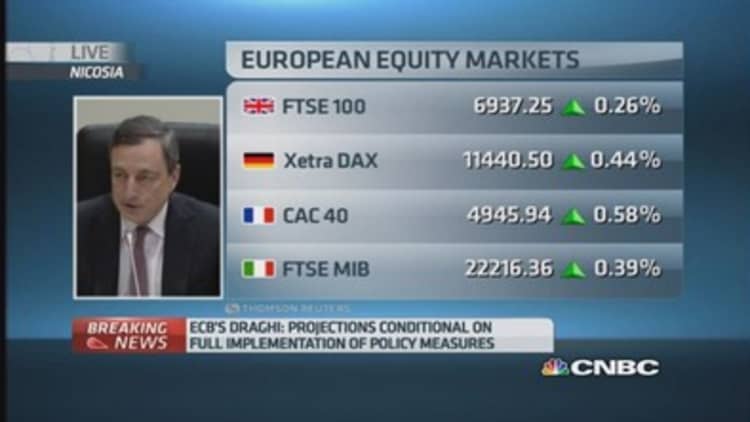

Read MoreEurope shares higher after ECB sets date for QE

The euro dropped had sharply ahead of Thursday's European Central Bank (ECB) policy meeting, falling from around 1.1170 to an 11-year low of 1.1061 in early trading on Thursday. After Draghi started speaking, however, the euro briefly spiked to a session high before falling lower again.

German bund yields traded around 0.4 percent after Draghi's comments, up from Wednesday's close and one-month low of 0.38 percent.

At the last ECB meeting in January -- the bank now meets every six weeks -- Draghi announced a 1-trillion euro ($1.1 trillion) QE program.

Implementation of the new program

In a statement accompanying Draghi's announcement, the central bank said it would purchase government bonds with a minimum remaining maturity of two years and a maximum remaining maturity of less than 31 years.

The ECB also said its intention is to be market-neutral, with the hope of creating as little "distortion" as possible.

The lender issued a list of international institutions located in the euro area on its website, including the European Investment Bank, the European Stability Mechanism, the European Union and Nordic Investment Bank, whose securities are eligible for the asset purchase program.

This initial list may be amended following the Governing Council meeting on 15 April 2015 on the basis of monetary policy considerations and reflecting risk management issues, the bank said.

Greek bond buying in focus

Draghi also emphasized that lending to Greek banks had been increased, with the ELA (Emergency Lending Assistance) hiked by 500 million euros Thursday, he said.

"The lending to Greece today is 68 percent of the Greek GDP, which is the highest in the euro zone. In this sense one can really say that the ECB is the central bank of Greece," he said.

"The last thing one can say is that the ECB not supporting Greece" he added.

Draghi said that the ECB was unable to buy Greek bonds under its new QE program for a "variety of reasons".

The ECB can only buy investment-grade bonds, but Draghi said the bank would be ready to reinstate the waiver on Greek paper, providing the conditions are in place for a successful completion of the country's review.