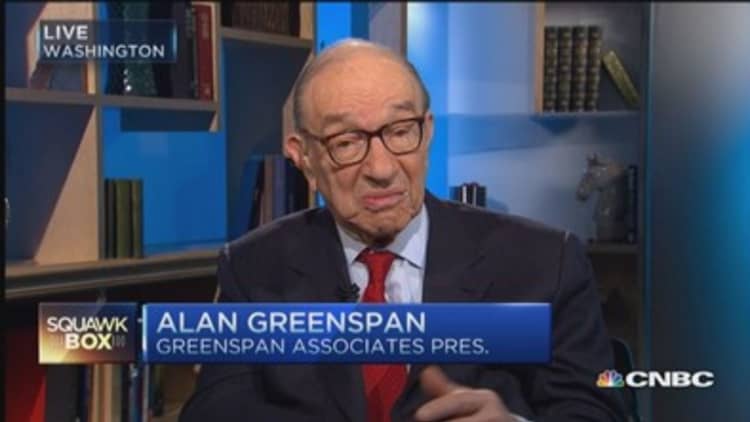

The massive quantitative easing bond-buying programs in the U.S. have not led to an overvalued stock market, though there may be overheated pockets, former Federal Reserve Chairman Alan Greenspan told CNBC on Friday.

"We can't argue that we're extremely overvalued in the marketplace, even though you're talking about individual bubbles," Greenspan said on "Squawk Box," referring to questions about whether technology and biotech stocks may be rising too quickly.

The Nasdaq's brief foray Monday above 5,000 for the first time since the dot-com bubble peak in March 2000 has stoked concerns.

Read MoreI disagree with Cuban on tech bubble: Steve Case

As awful as the bust was for many investors, Greenspan said, the economy can deal with the aftermath of that kind of bubble. "We can absorb a bubble without economic consequences, as indeed at the end of the dot-com boom showed us," he said.

But he warned, "If we get leveraged types of toxic assets, we have a very serious problem, as 2008 and 1929 showed us."

As far as the health of the U.S. economy, the former Fed chairman said growth is running 1 percent to 2 percent below what it should be because of stagnant worker productivity, measured by output per hour.

Gross domestic product expanded at a 2.2 percent annual pace, revised down from the 2.6 percent pace estimated last month, the Commerce Department said last Friday. The economy grew at a 5 percent rate in the third quarter.

"If you look at the data, we have zero productivity growth in the last couple of years," he said. "If you don't get productivity right in an economy, your economy is in trouble."

Read MoreDon't be too patient on rate hikes: Fed's Williams

Greenspan does believe the economy is being helped by lower oil prices. "The 50 percent decline in crude oil has had a significant impact on personal consumption expenditures in the United States."

"If we were, in fact, not getting that, we would be really be in pretty poor shape indeed," he warned. "It will continue provided we don't reverse the price change very rapidly."

On the euro, Greenspan said the single currency can not hold together unless Europe comes together politically, as the monetary union there was supposed to foster.

"The euro did work for nine years, 1999 through 2008, but the reason it did was we were in a global boom," he said, adding the rising tides of strong economic growth then helped pull along the weaker members.

In today's environment, many of those struggling euro nations would be forced to devalue their currency, Greenspan said, but they can't since they're locked in.

"The economic pressures pulling [the euro] apart are just too extraordinarily strong," he said. "And the continuing bailout of Greece suggests how strong they are."

After the European Central Bank announced its $1.1 trillion quantitative easing program would start next week, the euro on Thursday fell below $1.1000 for the first time since September 2003. In early trading Friday, it remained under pressure. The ECB also upped its economic growth forecasts to 1.5 percent, while cutting its inflation forecast for 2015 to zero percent.

—Reuters contributed to this report.