Like many other companies, Coca-Cola has been struggling with the strengthening dollar. But one options trader is betting on a pop in the soft drink giant.

On Monday, with no particular catalysts, traders placed a flurry of bullish bets on Coke. Calls outpaced puts by a margin of 6 to 1, and one trader bought 7,000 of the Coke April 41 calls for 59 cents each. Since each contract is for 100 shares, the trader is betting $413,000 that Coke will break above $41.59—3 percent higher than Monday's close—within a month from now.

"That is making a bet that this stock is going to recover a bit," said Dan Nathan, founder of RiskReversal.com and a CNBC contributor.

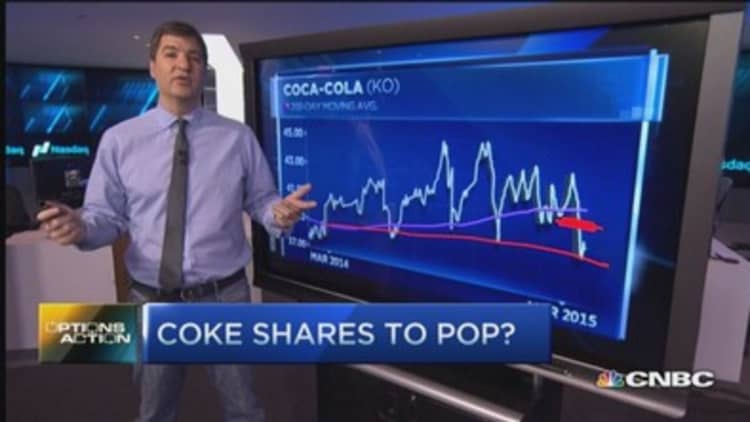

The call buy coincides with a key technical level for the stock. In the past six months, Coke has come nicely off the $40 mark three times.

"Each time the stock has bounced off these levels, it's rallied 10 percent," Added Nathan.

But despite the apparent floor at $40, Coke's technical setup presents a murky picture. The stock is very close to entering what traders call a death cross, when the 50-day moving average falls below the 200-day moving average. This is considered a bearish sign for technical traders.

With so much uncertainty surrounding the name, Nathan says options present a cheaper way to make a play on the Dow component.

"With the death cross looming, calls are a smart way to make a defined contrarian bet," said Nathan.

The expiry captures earnings on April 14, which will be investors' first look into how Coke is managing its currency exposure. Coca-Cola's 6 percent selloff this month coincided with a rally in the greenback. Since March 1, the U.S. dollar index is up 4 percent. About 53 percent of the company's sales are from outside North America, according to FactSet.

"This is when hopefully they should be able to give a little bit better guidance about how they are dealing with the dollar strength," said Nathan.

During the company's February earnings call, CEO Muhtar Kent warned that Coca-Cola will face "a bit more volatile" macroeconomic environment.

Coca-Cola is down 4 percent year to date.