As diplomats try to sell an agreement on Iran's nuclear program to power brokers in their respective countries, one of the potential stumbling blocks will be the pace at which Western powers roll back sanctions on the marginalized nation.

Iran and the so-called P5+1 group of nations on the other side of the negotiations surprised the world on Thursday by delivering a more detailed preliminary agreement than many anticipated.

Between the mid-1990s and 2006, the United States and United Nations imposed sanctions on individuals and entities for aiding Iran's illicit nuclear program, or assisting terrorist organizations. Sanctions imposed for those reasons may be more difficult to suspend and ultimately drop, Richard Nephew, former lead sanctions expert for the State Department and a program director at Columbia University's Center on Global Energy Policy, told CNBC.

But the industries that were hit more indirectly by the sanctions are a different matter. Companies that will most immediately benefit are those that have suffered from sanctions meant to put pressure on the Iranian economy as a means of bringing its leaders to the negotiating table, said Nephew. Largely enacted over the last five years, those measures built on a 2006 United Nations resolution and brought Europe, Japan, Australia and other nations in line with the U.S. policy of isolation.

Who wins first

A priority for the Iranians is restoring access to the SWIFT, the financial messaging system that transmits and tracks international transactions, said Djavad Salehi-Isfahani, an Iranian economist at Virginia Tech. For the last three years, SWIFT has suspended services to Iranian financial institutions that are subject to sanctions.

"The SWIFT sanctions are more important at this point than any other type of sanctions because it affects all manner of industry and agriculture," said Salehi-Isfahani.

Current rules essentially prohibit international banks from using SWIFT to do business with Iranian banks. Once the international community determines that Iran's nuclear program complies with a final agreement, those Iranian banks will no longer be designated as bad actors because the nuclear program itself will no longer be designated as a problem, Nephew explained.

Read MoreIranian finance, energy sectors could soar on deal

Allowing Iranian crude producers access to international oil markets is also a top priority, Salehi-Isfahani said. The government is hugely reliant on oil revenue; some market watchers estimate that Iran could bring another 1 million barrels onto the international oil market in relatively short order if sanctions are lifted.

Parts of the Iranian economy have already received relief under a Joint Plan of Action that suspended some sanctions on Iran's financial, petrochemical, automotive and insurance industries in exchange for concessions on its nuclear program.

Iranian automakers have increased output by about 60 percent in the first 11 months of the Iranian calendar year ended in March after the industry nearly ground to a halt under the weight of sanctions. That has been a boon to average Iranians because the industry directly and indirectly employs about 840,000 people, according to research by strategic consulting firm Atieh Bahar.

Now, European vehicle makers are looking to return to the Iranian market. France's Peugeot is gearing up for a joint venture with leading domestic automaker Iran Khodro, and Renault is exploring a re-entry.

Read More

An agreement would likely extend that relief to Iran's rank-and-file manufacturing sectors, which are not covered by the Joint Plan of Action, said Salehi-Isfahani.

Iran makes a wide range of household goods, from breakfast cereal to medicine, for consumers both at home and abroad.

However, producers struggle to provide the quality that middle-class Iranians seek, in part because they lack access to advanced technology, said Salehi-Isfahani. Some manufacturers have put off capital investments until they can resume purchases from European equipment makers, he added.

A lasting deal could have downside for some sectors. It may be a net detriment to Iran's textile and agricultural sectors because they would lose the protection from import competition afforded by the sanctions, Salehi-Isfahani said.

Meanwhile, companies in the United Arab Emirates and Turkey would likely be early winners, Renaissance Capital wrote in a recent note. Those two countries, along with China, emerged as Iran's biggest trade partners after the European Union imposed sanctions.

Read More Foreign insurers scramble for India foothold

Turkish energy companies, airlines, financial firms, consumer goods makers and industrials in particular could benefit as the country's border with Iran opens, giving it access to 80 million Iranians. Renaissance notes that Turkish refining monopoly Tupras got nearly half of its crude oil from Iran in 2011, before the most forceful of the sanctions against the Iranian oil industry hit.

Russia's government-dominated energy sector will also expect access to Iranian projects given Moscow's long-standing support for lifting sanctions, Renaissance said.

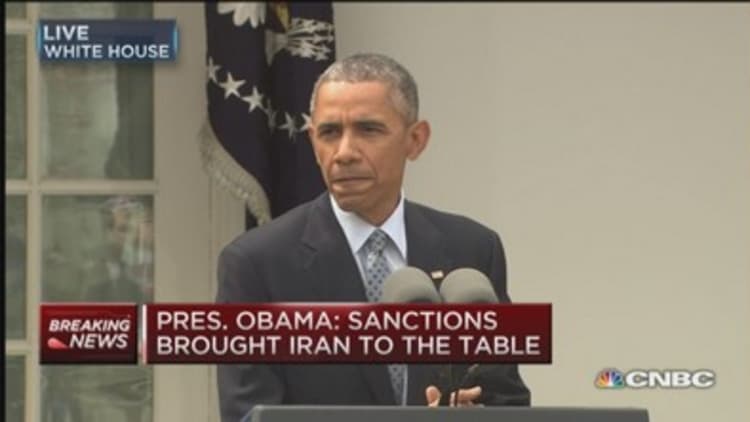

The United States could face some of the steepest barriers to entering the Iranian market following years of foreign policy that prohibited virtually all trade with and investment in the country. President Barack Obama must also contend with a Congress that could yet pass legislation that would scuttle a deal.

That would not necessarily mean the end of rapprochement between Iran and the wider world. Tehran could stick to the terms of Thursday's preliminary deal and resume trade with Europe, or else continue on its current path of reorienting toward Asia, experts said.

The stakes are high for an Iranian economy that might have boomed were it not for sanctions as well as for potential trade partners and foreign investors. Iran has a gross domestic product nearly equal to Austria, wages that are competitive with Vietnam and a stock market capitalization on par with Poland.

Read MoreIran talks: Agreements reached on key parameters

The United States will try to strike a balance that maintains pressure on Tehran but provides an incentive to stick to an agreement brokered over many months in Switzerland. Iran, battered by years of escalating sanctions, will seek the broadest, fastest relief the West can stomach.

"Our original mindset when we went into this was that if they're prepped to go big then we could go big, too," Nephew said.