Material concerns about hydraulic fracturing companies like Pioneer Natural Resources should ease in the coming years despite prominent investor David Einhorn's "valid points" about the industry's weaknesses, one oil and gas analyst said Monday.

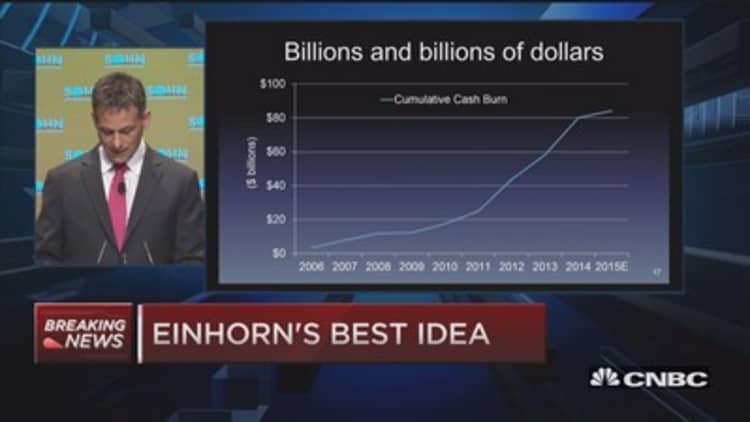

Einhorn, founder of Greenlight Capital, on Monday criticized Pioneer's cash burn and perceived lack of growth. After a speech in which he called it the "motherfracker" and slammed its business model, the company's stock ended about 2 percent lower.

"A lot of companies in the sector certainly have a hard time making returns when you have a sudden reversal in commodity prices like we've had over the last nine months here," said Leo Mariani, oil and gas exploration and production research analyst at RBC Capital Research, in an interview on CNBC's "Power Lunch."

Read MoreLive: Hedge funds' best ideas from Sohn Conference

"I think you will see capital directed toward more profitable areas in a low-price environment," Mariani added.

Companies will eventually adjust to a cheaper crude environment as input costs fall, he contended.

Einhorn said fracking's expenses lead to disappointing returns, especially as West Texas Intermediate crude futures sit below $60 per barrel.

Read MoreBeware, oil rally is 'premature': Analyst

In a statement, Pioneer pointed to its quarterly earnings release scheduled for Tuesday and its conference call slated for Wednesday.

Mariani added that "a lot of these costs slow down" after companies operate in the shale space for an extended time.

The reaction to Einhorn's statements shows the oil industry will see "continued volatility," noted Jeff Kilburg, KKM Financial CEO and a CNBC contributor, on "Power Lunch."