Following a volatile week for European bonds and equities, a leading CFO has told CNBC that uncertainty in the region is a concern for businesses.

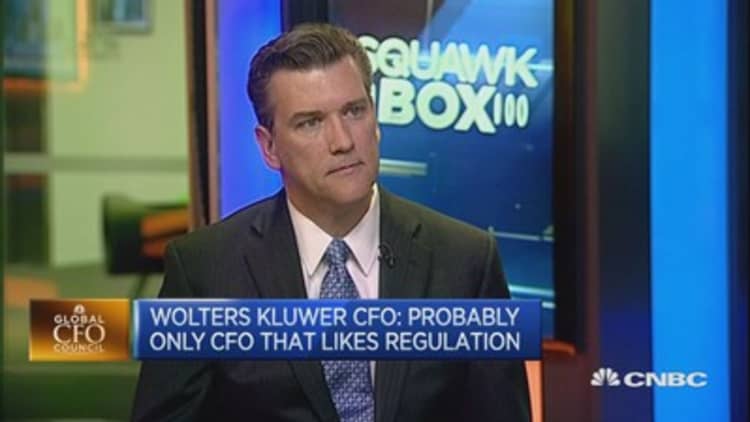

Kevin Entricken, chief financial officer of Wolters Kluwer, a global information services company based in the Netherlands, shared his views on global economic trends with CNBC on Friday.

"I would share the view that in many parts of the world there is a more optimistic tone, I would say. Certainly in the United States, in North America we are beginning to see that. Certainly in our emerging and developing market we are seeing very good progress in our business there," he explained.

But uncertainty in Europe was an issue for businesses operating in Europe. He said: "We had seen in the prior year a bit of a slow recovery in Europe but in the second half of the year that changed a little bit and we saw that continue into the first quarter, so that uncertainty is something we are experiencing in our business there.

"Probably the biggest challenge I see right now is the uncertainty around the European economy and I think once we start to see small and medium-sized businesses start to open up their budgets a little bit, we will start to turn that corner. But I do think that some of the uncertainty in the marker created by things like Greece are a bit of a concern to people operating in Europe."

Europe's markets were roiled this week following comments by the European Central Bank President Mario Draghi on tackling volatility, prompting a spike in bond yields and a sell-off in equities. Another major factor has been Greece's continuing reforms-for-rescue talks with its international creditors.

Read MoreRun for cover: Draghi sparks global volatility

Entricken also discussed the likelihood of the U.S. Federal Reserve raising interest rates. According to a survey released in May, 44 percent of CNBC's Global CFO Council expects the Fed to hike rates in the fourth quarter of 2015.

However, a downward revision of U.S. gross domestic product data at the end of May could affect the Fed's plans. The government cut its first-quarter estimates from an annual growth rate of 0.2 percent to a contraction of 0.7 percent.

Entricken said: "The first quarter for us was quite good. With the revision down, though, of GDP in the last quarter, it is a little bit unknown what the Fed will do going forward."