For the past week, Jim Cramer has highlighted the health care group as being ripe for consolidation. Not only are more Americans becoming insured these days, but more baby boomers are aging and require health care. As a result, Cramer singled out the health care plays as being in the perfect sweet spot.

Sure enough, not only did investors learn on Monday of Anthem's potential bid for Cigna but it was also announced that Cramer-fave CVS Health will purchase Target's pharmacy business for $1.9 billion. Some 1,700 Target pharmacies will be rebranded as CVS stores within a store, and many investors expect this to be significantly beneficial to CVS' earnings by 2017.

"This also seems like a no-brainer for Target because, in addition to the obvious $1.9 billion payday, they don't have any real edge in the pharmacy space so offloading this business should boost their margins," the "Mad Money" host said.

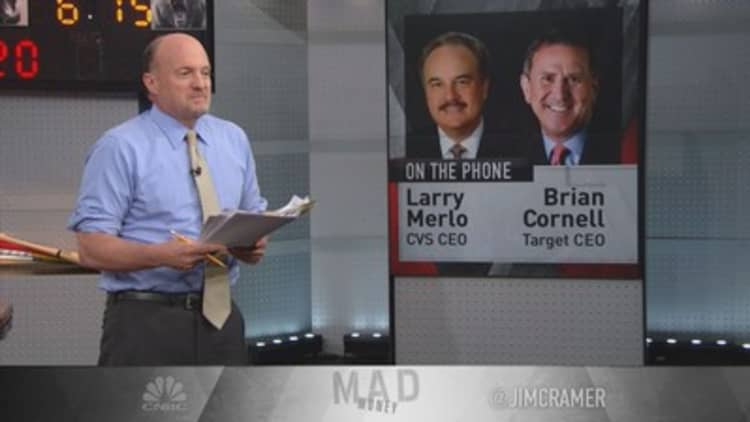

Cramer ultimately thinks this is a win-win deal for both CVS and Target. To hear more about what is in store for both companies, Cramer spoke with CVS Health CEO Larry Merlo and Target CEO Brian Cornell.

Cornell explained that Target is excited about the partnership's potential to bring scale and capabilities to the Target guest experience. CVS' Merlo added that while there could be one-off costs associated with the partnership, not only will it help the bottom line from a long-term perspective but it will expand CVS into new markets, such as Salt Lake City and Seattle.

"We will go through a period of integration where we will have some one-time costs, but the transaction will be at least 12 cents accretive in 2018 and beyond. So, we're excited about the long-term prospects that will certainly add value for our shareholders," Merlo said.

Cornell added that, at the end of the day, this deal was about adding growth for both Target and CVS and growing script count together. The deal will also help to align with CVS' new, broader health care focus, which became evident when Merlo made the decision in 2014 to ban tobacco sales in stores.

----------------------------------------------------------

Read more from Mad Money with Jim Cramer

Cramer Remix: My foolproof guide to the Fed

Cramer's 6 vital rules to short selling

Cramer: Best stocks when the Fed tightens

----------------------------------------------------------

"This relationship will provide consumers with expanded options and access to our unique health care services, and clinical expertise that has been proven to provide better health outcomes and equally important, lower overall health care costs," Merlo added.

Cramer asked Cornell if investors can now expect to see a "mall-ization" of Target. Could this mean that Williams-Sonoma could be a partner in housewares, or larger cosmetic companies joining the game at Target?

"It is absolutely a unique one-off opportunity. The chance for us to partner with someone who brings scale, experience, expertise into the space can help us fulfill our commitment to wellness with the guest. But you should not expect to see this happen in other places," Cornell said.

Questions for Cramer?

Call Cramer: 1-800-743-CNBC

Want to take a deep dive into Cramer's world? Hit him up!

Mad Money Twitter - Jim Cramer Twitter - Facebook - Instagram - Vine

Questions, comments, suggestions for the "Mad Money" website? madcap@cnbc.com