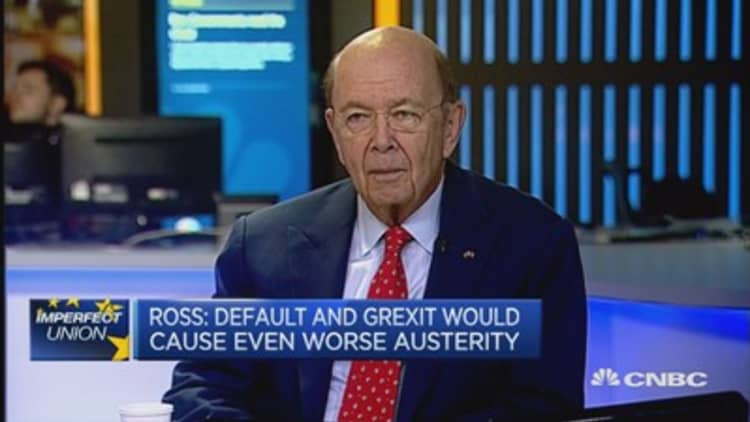

U.S. billionaire Wilbur Ross told CNBC that he was confident his investment in Greece's third-largest bank would work out, even as the country appears to be edging closer to defaulting on its debt.

Ross, well known for his investments in distressed assets, is one of a group of investors who pumped 1.3 billion euros ($1.47 billion) into Greece's Eurobank Ergasias last year.

Read More Greece defiant, accused of 'breaking all the rules'

Greek banks have been pummelled by an economy that has slipped back into recession and an exit of cash amid uncertainty over the country's future. Talks between Greece and its international creditors over unlocking aid for reforms collapsed at the weekend, raising concerns that Athens is heading for a debt default that could result in it leaving the euro zone.

However Ross insisted on Tuesday: "I think it will (work out) because I think they will make a deal at the end of the day."

Ross said the investment in Eurobank Ergasias was loss-making, but added: "we're used to the rollercoaster -- that comes with the territory. If this works out as well as Ireland I'd be thrilled."

Last year, Ross sold his stake in Bank of Ireland for almost half a billion euros – almost triple the value of an investment made during the euro zone crisis.

Ross said he believed that Greece would reach a deal with its creditors because a default would make the economy a "shambles."

"Greece can't afford to default, there's no liquidity in the country whatsoever at this point," he said.

"The banks, of which we have one, are 80-billion odd euros into the ELA (Emergency Liquidity Assistance). A default doesn't resolve those issues and would make the economy a shambles. So they will make an accommodation," he added.

Because of deposit outflows, the Bank of Greece has replaced the loss of deposits with emergency funding from the European Central Bank, officially known as Emergency Liquidity Assistance.

Read More'The ball lies firmly with Greece': ECB's Draghi

Greek banks are reliant on this funding and analysts warn that if the central bank curbs this liquidity, Greece may have no option but to impose capital controls.

Asked whether the imposition of capital controls would be catastrophic for Greece, Ross added: "I think it would be because there's no liquidity there right now. And if you don't have liquidity, how do you have a functioning economy?"