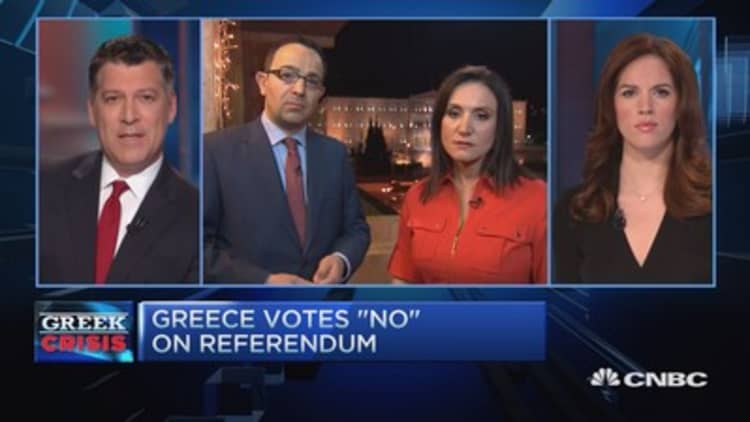

Greece's decision to reject the terms of its creditors sent shockwaves across global markets on Sunday, even as experts said the fallout should be limited.

Markets fell sharply in the wake of Sunday's referendum that saw an overwhelming majority of the public vote down the country's deal with its creditors. Although many have warned of the risk of contagion that could infect other markets, some said the prospect appeared remote for now.

Read MoreGreece live blog

"Greece is not Lehman," Christian Menegatti chief strategist at Windhaven Investment, said on CNBC. (Tweet This)

Yet at a minimum, a consensus appeared to be forming that Greece was closer than ever to being forced from the 19-nation currency bloc—something once considered unthinkable when it was among the first set of countries that formed the euro less than 20 years ago.

Wolfgang Piccoli of Teneo Intelligence said there's now a 75 percent chance that Greece will leave the euro.

"We are running short of time. (Greece Prime Minister Alexis) Tsipras is stronger than ever. (He will) ask for more concessions from European counterparts. So we are set for a collision here."

"This process takes weeks, not days," he said.

Other analysts downplayed the risk that Greece's woes could precipitate a new global pandemic, such as the collapse of Lehman Brothers that led to the 2008 crisis.

"The financial interconnection that Greece has with the rest of the world is nowhere near what Lehman was," Menegatti said. "The issue here is this is not just pricing in risk. This is pricing in uncertainty. We don't know what a Greek exit really means in the minds of investors. and investors are selling off across the board."

futures traded about 1 percent lower after opening more than 1.5 percent lower. Dow futures were set to open about 200 points lower.

"You have to watch the banks and the sovereign banks and how it's going to react," said Michael Farr, president of Farr, Miller & Washington. "Certainly our markets go down on the open. This is going to be a very messy, very noisy process. ... Keep an eye on your long-term goals because this is not going to be pretty."

As Farr expected, gold and the dollar were higher in pre-market trade while oil declined.

Bond yields fell, with the U.S. plunging to near 0.57 percent and the 10-year yield below 2.30 percent. The benchmark yield held near 2.38 percent on Thursday before markets closed for the Independence Day holiday in the United States.

The German 10-year bund yield fell below 0.80 percent. The Greek 10-year bond yield was also lower, but hit less than its international counterparts.

In Asia, stock indices in Japan and South Korea traded more than 1 percent lower, slightly off opening lows. Chinese indices in Shanghai and Hong Kong jumped after opening flat, supported by local policy moves over the weekend.

For U.S. investors, Europe's market action will be in greater focus.

"We have to wait and see what happens what happens in Europe," said Peter Costa, president of Empire Execution. "I think Europe's a much better indication."

The euro weakened against major world currencies, trading just above $1.10 against the U.S. dollar. Earlier, the euro hit a low of $1.0967, its lowest level since June 29.

Dan Greenhaus, chief global strategist at BTIG, said investors shouldn't flock to the U.S. dollar on the basis of international news alone.

"The argument in favor of the U.S....because it's the cleanest shirt in the dirty laundry… in a general sense, sure, but that's not really a riveting investment idea," said Dan Greenhaus, chief global strategist at BTIG.

"You can't really go to people and say, look at China, look at Greece, therefore the U.S. is where you want to be," he added.

Greek banks will remain closed on Monday. Yet paradoxically, Greece's embattled prime minister appeared to be in a stronger position than ever, even as the country remains in the throes of a wrenching economic adjustment.

"Tsipras' priority was to unite the party and make them stronger. He has achieved that," Piccoli said.

Capital controls in Greece are hurting its tourism industry, arguably the country's strongest selling point. There are "50,000 tourists missing per day," said Anastasios Economou, founder of iGroup.

As for market reaction, he expects action similar to last week's selloff and slight recovery.

"What's you're seeing is a ... decoupling of Greece and the rest of Europe," Economou said. "This week is going to be similar—the market's not going to react in panic. And one thing is certain, the 'no' vote has pushed any possibility of a deal further out."

Read More

See what futures are doing here.

Correction: This story has been updated to reflect that there are 19 countries in the euro zone.