Breaking it down

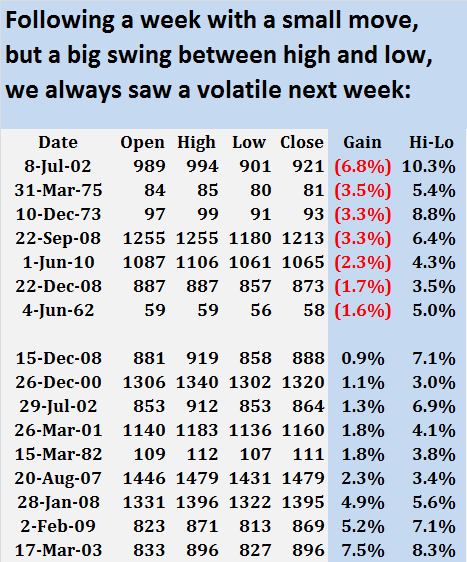

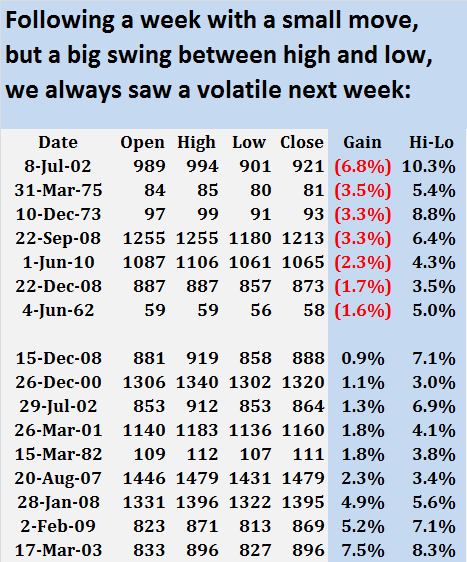

Including this week, there have been exactly 200 weeks since 1950 when the S&P 500 saw a high-low difference over 6 percent. There have been 1,457 weeks when the overall return has been between -1 and +1 percent. But there have been only 16 weeks prior to this one where both those things happened: a big swing but a small return.

The following weeks all saw big moves.

In the 16 previous times, the best week was a 7.5 percent return. The worst was a loss of 6.8 percent.

There were nine up weeks, and seven down weeks.

While the average return appears to be small—a median 1 percent gain and a mean of 0.27 percent—that's not at all the story.

There was at least a 1 percent move, either up or down, in 15 of the 16 weeks. The smallest return was 0.93 percent, so almost a full percent move anyway.

There was a move of at least 3 percent in seven of those 16 weeks, or almost half the time.

In no case at all was there a small move. Not a single week saw a return between -1.5 percent and 0.9 percent.

Be ready for more volatility

The difference between intraday highs and lows remained high. The average spread for those weeks was 6 percent, just what we are experiencing now.

Even in the quietest week of them all, the gap between high and low was 3 percent, which is higher than the average of every other week (over 3,400 of them) since 1950.

The lesson here is that if history repeats itself, this week might actually be quieter than next week. Be ready for a big move one way or the other, and a big spread between highs and lows.

The only thing we don't know is if we'll end next week positive or negative. We just know it will be a bumpy ride.